Did you ever think why nobody talks about the upcoming IPO in share market? Every day there are new Initial Public Offering (IPO) in any Financial Market, like NYSE and NASDAQ. But, in a rare occasion, Media push an IPO. The purpose is to pump that IPO. When it happens, you get a Hot IPO.

There are many ways to make trading and many financial markets where to invest. But the IPO market has its own niche.

It is not so easy for a retail trailer to invest in an upcoming IPO. The reason is that not all the brokers give a full offer of Financial Instruments. Indeed, almost for every new IPO listing date, a broker doesn’t offer to trade the new IPO.

This is a real problem with brokers that offer to trade CFD. Instead, the most of the brokers which offer to take shares can let you trade the IPO.

Who trades IPO knows the risk around it. A company gets the first evaluation before to become public. When the Initial Offer from the floor becomes Public, the Stock is difficult to trade in that moment. Then the risk becomes consistent.

On Profiting.Me the focus is more on the Pumped IPO, not to trade every company in the IPO Calendar. The reason is that only a few traders could use brokers that offer to trade any upcoming IPO in share market.

A Pumped IPO gives profitable advantages and systematic disadvantages for the retail trader.

Initial Public Offering (IPO)

An Initial Public Offering (IPO) is the first time offer of a company stock to the public.

A usual practice is that a company sells its shares to institutional investors. Then, they sell those shares to the general public for the first time, by a securities exchange.

In this way, a Private Company becomes a Public Company.

Going Public a company gets positive and immediate consequences:

- Company raises capital expanding its evaluation for future growth.

- Monetize the initial investments by owners, angels, and funds (early seed, round A and B).

- Management or Repayment of the initial debts.

- The company becomes an enterprise tradable by the public.

- The IPO launches the company shares in the open market. Trading these shares the Public investors transfer money between them.

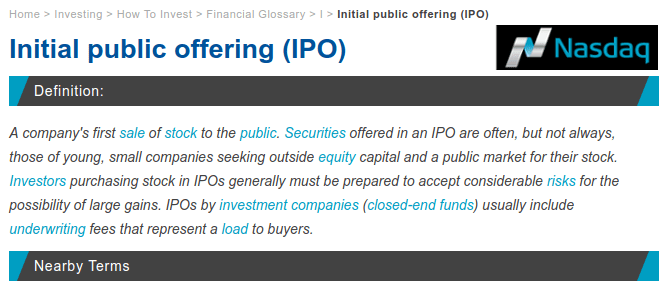

NASDAQ gives a particular IPO definition:

This IPO definition includes some important details:

- Often, but not always, IPO securities are those of young, small companies.

- Young Companies that go public seek outside new capital and a public market for their stocks.

- Investing on an IPO gives considerable risks for the possible large reward.

- An IPO is a Close-end-Fund because the company issues a fixed number of shares that it cannot redeem. Some of these shares are for short trades.

- An upcoming IPO in Share Market can include an underwriting fee.

Underwriting, Underwriters and Underwriter Syndicate

Even if a company can sell shares by itself in a public offer, it never happens. For upcoming IPO in Share Market, the company uses the support of an underwriter. It has a cost for its service that is the Underwriting Fee.

The biggest underwriters are Goldman Sachs Group Inc., Credit Suisse Group, Merrill Lynch and Morgan Stanley.

When there are several Underwriters, it means that there are many activities. In this case, a single firm is not able to manage all the work only by itself.

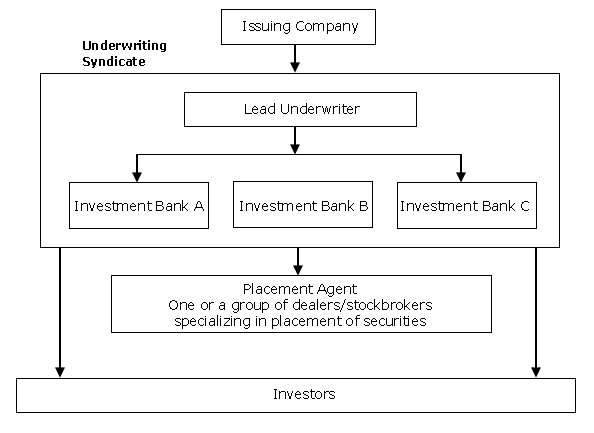

The Underwriter Syndicate is the group of investment banks and broker-dealers.

They assist the company for the upcoming IPO in Share Market. The leader of the Syndicate is the Lead Underwriter.

The Underwriter Syndicate manages the security offer and it sells to broker-dealers.

The syndicate takes the risk and the exclusivity.

This means that the Syndicate spread the risk to the investment banks involved. It takes the full Securities. Then, it has to sell them.

Upcoming IPO in Share Market, the securities demand should reach the expectation. If the demand will not be enough, the syndicate will have to hold the remained securities. This exposes the underwriters to the risk of a price decline.

The Underwriting Spread is the reward of the Syndicate. It is the difference between the price paid for the securities and the earnings by the Public Offer.

The risk is in proportion with the involvement of the underwriters. So the Lead Underwriter takes the highest risk and highest spread.

This picture from Gulf Base shows a schema about how is structured and Underwriting Syndicate:

Roadshow and IPO Allocation

Having an Underwriting Agreement, banks make a Registration Statement for the SEC. Then, the SEC will investigate the company to check financial data and details.

Passing this check, the SEC approves the IPO. So together with the underwriters, the SEC will set a Date for the upcoming IPO in share market. After this, the underwriters make a Prospectus.

The IPO Prospectus is a disclosure document. It describes all the financial information and securities to show to prospective investors.

As you can understand, having the Prospectus, the Roadshow, also known as the Dog and Pony Show, begins.

During the Roadshow, the Underwriters contact big institutional investors offering shares. In this way, the early demand for the shares gets an evaluation.

The roadshow involves big institutional investors, pension funds so as Individual Investors.

An IPO Allocation happens when a prospective investor wants to invest in the IPO. The Underwriters Syndicate has the legal right to offer shares at a favorable price.

This price is set with the prospective investor. So, the Syndicate allocates IPO shares for the prospective investor. This happens before that the stock becomes listed on the Stock Exchange.

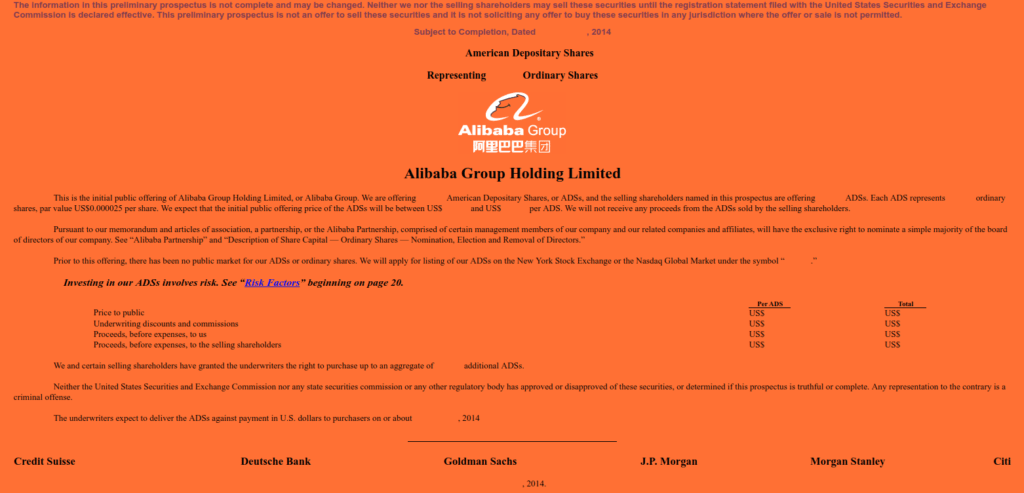

SEC Form F-1 Registration Statement Alibaba Prospectus

If you want to see an example of Prospectus Document, you can read the Alibaba Prospectus in its SEC Form F-1 Registration Statement.

Communication Agencies have created this prospectus for the BABA upcoming IPO in share market. It is in the SEC Archive. It is consultable for everybody. Reading it you can learn many things.

It is a very nice work, very descriptive and very accurate. The MerchantCantos Agency made the infographics for the Alibaba Prospectus.

Upcoming IPO in Share Market

Together with the Company, the underwriters define the offering price to sell shares. This is a crucial step for the upcoming IPO in Share Market.

The chosen price will determine the capital that the company will gather by the initial IPO sale.

The offering price depends on three things:

- The Ambition of the Company.

- Roadshow Results.

- Current Market Conditions.

After the initial IPO sale in the Primary Market, the company will get no further capital. Instead, the stock will be available for trading in the Secondary Market. Then, the shareholders will exchange their shares trying to sell them at the best.

Stock Exchanges give the advantage to manage the large part of the public share sells. So, a company listed on a Stock Exchange, like NASDAQ or NYSE, is part of a very large and prestigious market.

Stock Exchanges knock to the door of the companies offering their services. Then, the company and underwriters choose in which Stock Exchange get listed.

So, the underwriters join the company in the upcoming IPO list NYSE or NASDAQ. Instead, for emerging markets, underwrites could join a company in the upcoming IPO list India or others. This depends on large interests, markets, country regulations and more.

For example, Alibaba is a company founded in China with offices in several countries. But the BABA Stock is in the list of NYSE.

Primary Market

The primary market includes the creation of securities. It is in the Primary Market that firms sell (float) new stocks and bonds to the public for the first time.

This is the origin of the upcoming IPO in share market, where an Initial Public Offering takes place.

The Primary Market for the upcoming IPO is the market where an initial public offering takes place.

In the Primary Market investors buy securities from the issuing company.

The primary market is also where there are bond offers. Then Governments or Public Sector Institutions raise money through bond offerings.

Secondary Market

The Secondary Market is the Stock Market. Then, it is where stocks are traded.

The New York Stock Exchange (NYSE) is a Secondary Market. Nasdaq is a Secondary Market. In the same way, all the major exchanges around the world are Secondary Markets.

In the Secondary Market, the upcoming IPO gets open to retail traders. The company will stop to raise money, but its shares will get exchanged.

Traders trade between them with the rules of the Stock Exchanges. The IPO company is not more involved in the transactions.

The IPO Valuation

The Market Condition for the upcoming IPO in the Share Market is very important.

You know that the IPO is a sell to raise capital. So, if there is no real demand willing, the initial IPO sale will be poor.

You realize this seeing with which price the company goes public after the trading on the floor.

The negotiations on the floor, so as the roadshow, can give a result that is under the expectations. When this happens the company goes public with a low share price that is below the price expected.

The Evaluation Process of an upcoming IPO in Share Market works on two groups:

- Quantitative Components.

- Qualitative Components.

Weeks before of the upcoming IPO in Share Market, the media inform the world of the initial IPO sale. So the most of the investors know about the IPO event by the media. This is so for both retail traders and institutional investors not involved in the roadshow.

Is it so important that everybody in the world knows about the upcoming IPO in Share Market? The answer is: not at all.

It is important to develop the demand by the roadshow and by other relevant investors. So, underwriters inform those investors that can have a real interest to buy.

They can do this by themselves or by investor relations agencies.

When you hear about the IPO, you don’t know about the possible share price. Only the involved parts know how much the company gets valued.

These include investment bankers, the SEC, insiders and more.

Quantitative Components for a Proper IPO Valuation

The success of any upcoming IPO in Share Market comes from the demand.

An IPO is a selling process and it needs to meet the right demand.

Stronger is the demand to buy shares of a company, in its initial IPO sale, higher will be the IPO price.

Let me make a distinction:

- Evaluation of the Company.

- Valuable Company.

These two things are different.

A strong demand shows that the company will have a high evaluation. But this doesn’t mean that the company is more valuable.

In the same marketplace, several companies produce and work in the same way. You can compare them.

The comparison would show you that they could be valuable in the same way, getting a similar result.

How the Demand Affects the Upcoming IPO in Share Market

Companies in the same marketplace, which run for their IPOs, can get different IPO Valuations.

The reason for this disparity is the demand willing.

Timing is important. Is the upcoming IPO in the share market happening at a propitious moment?

IPOs of companies from the same marketplace can happen in different moments.

Some companies can get a very high IPO Valuation by the Demand.

Instead, others can reach a very low IPO Valuation because at the IPO Listing Date the interest to buy them was very low.

As I told before:

A strong demand shows that the company is going to have a higher IPO valuation.

Why Timing Is so Important for the Upcoming IPO in the Share Market

In a specific marketplace, different companies can run the same business. They can use the same features so as have the same providers. Besides, they can apply the same Business Processes and earn similar rewards.

You see that these companies are identical.

In an upcoming IPO in share market, the demand can be the result of a trend.

For example, the demand in a marketplace can rise so much to turn in a financial bubble. When this happens, the valuations become very high.

Identical companies in the same marketplace can have different IPO Valuations.

At the beginning of the demand, an upcoming IPO in share market can get a low valuation. The company could even get an undervaluation.

Instead, when a bubble is imminent the IPO Valuation can reach a very high extreme.

This shows why timing is important for an upcoming IPO in share market.

This has a concrete importance for IPOs of similar companies in the same marketplace.

Companies of a marketplace, which run for an IPO when the demand is high, get a higher evaluation. Then, they receive much more capital of investment.

The company sells its shares when the demand is high, taking an enormous advantage.

This affects the share price of the company when it goes public. The IPO Valuation defines a high share price so as a low share price.

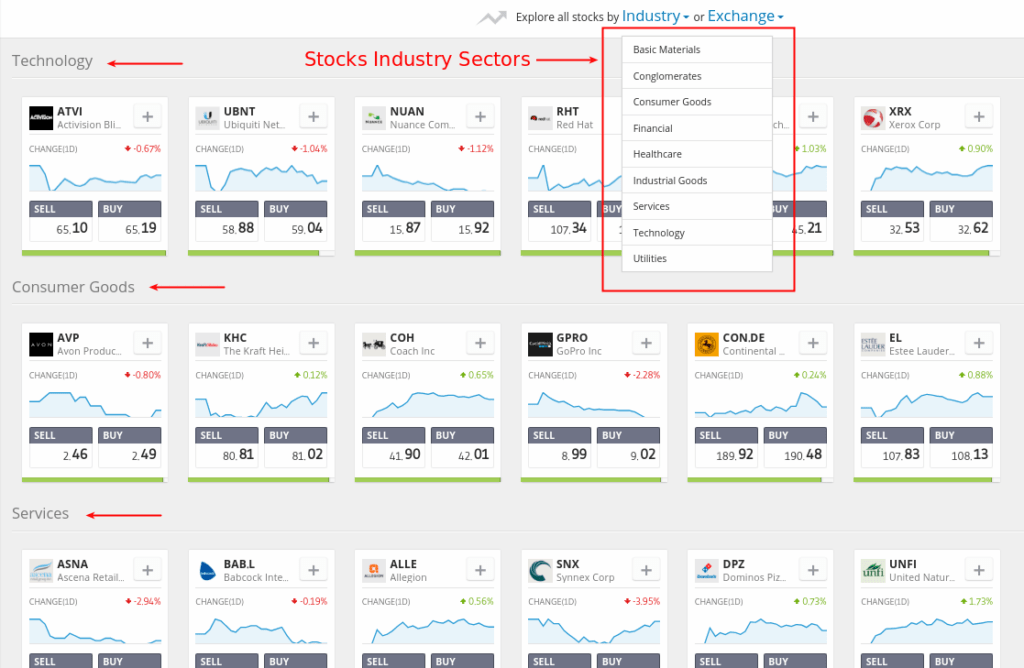

Industry Sector and Growth Projection influence the IPO Valuation

An IPO Valuation depends on the future growth projection of the company. In the same way, the Industry Sector of the company influences the IPO Valuation.

For an Industry Sector, there are many companies from that sector in the share market.

An upcoming IPO in share market is comparable with other public companies. These companies come from the same Industry Sector.

Competitors in the share market can affect the IPO Valuation.

The IPO Valuation could involve several other valuations that are made on competitors.

Investors who use to invest in an Industry Sector would continue to invest in IPOs from the same Sector.

This means that investors want to pay the amount of money that they are already paying for others.

The Growth Projection has a high importance in the evaluation process.

The Growth is the main reason for which a company decides to go public.

Then, running the IPO, the company raises more capital for a further growth.

The successful sale of an IPO can depend on the Growth Plan for an aggressive future growth.

Qualitative Components for a Proper IPO Valuation

The Story of the Company defines the Qualitative Components for an IPO Valuation.

I am talking about the progress of the company to improve its services and products. Besides, also negative things like disputes for patents and lawsuits with other companies.

Qualitative Components that define status and story of the company are very powerful.

They are as powerful as the Quantitative Components.

New products and new technologies promoted affect the IPO Valuations.

Even if a company has low revenues, new technologies can open the door to a high IPO Valuation.

Besides, in upcoming Hot IPOs, companies promote different and strong qualitative components.

For example, a company, with low revenues, promotes its innovative services or products. In the IPO sale, this company could reach a multi-billionaire dollars capitalization.

Products or service that can change the way to do something, make the company attractive. Indeed, such company can reach a very high IPO Valuation.

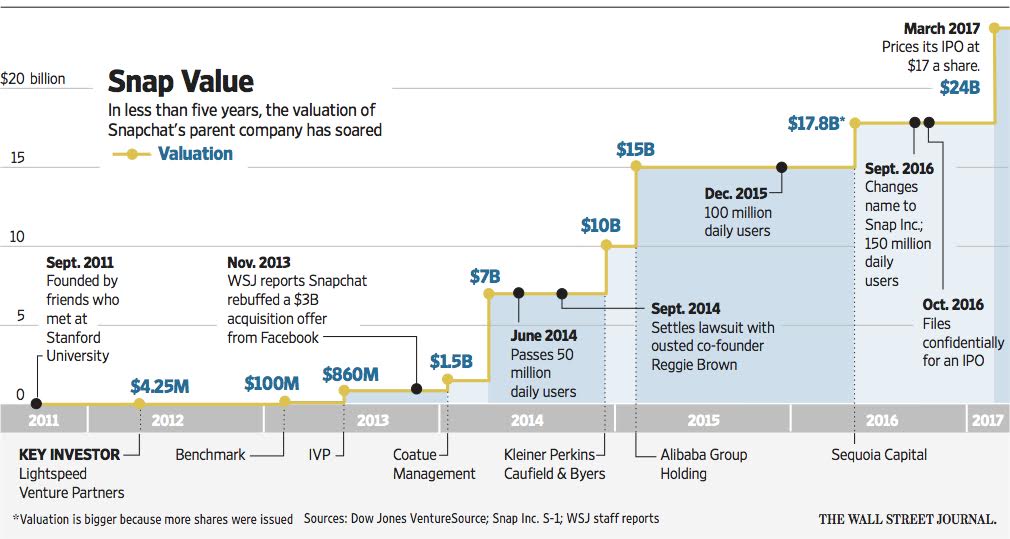

This is the case of SnapChat Inc.

CNBC reported the SNAP Roadshow in NYC on the Squawk Box Show and Squawk Alley Show.

- Squawk Box is the ultimate “pre-market” morning news and talk program about business and politics stories on CNBC.

- Squawk Alley is the destination for news regarding tech on CNBC.

Marketability and Attractiveness of a Business in the IPO Sale

A Company that runs for an IPO has to show all the best Qualitative Components it has to get the highest IPO Valuation.

This shows the importance to highlight, in the upcoming IPO in share market, that the company is solid.

For this purpose, before of the upcoming IPO in share market, a company can change the top managers.

This happens adding veterans and famous managers from the same Industrial Sector. This gives the appearance of a growing business ruled by an experienced management.

The company can also hire consultants and others with the purpose to give a solid public image.

Consultants or agencies work to improve the company reputation. They pump the upcoming IPO in share market.

Now you can understand very well, that the truth around an IPO sale is the marketability of the business.

Marketability and Attractiveness of a business become more important of the business itself.

This sounds not good. But, as you know an IPO is a pure sell. The company wants to sell its shares at the best price possible.

This is why IPO investors work to understand the real facts and the real value of the company. Besides, they work to understand the real risk on investment.

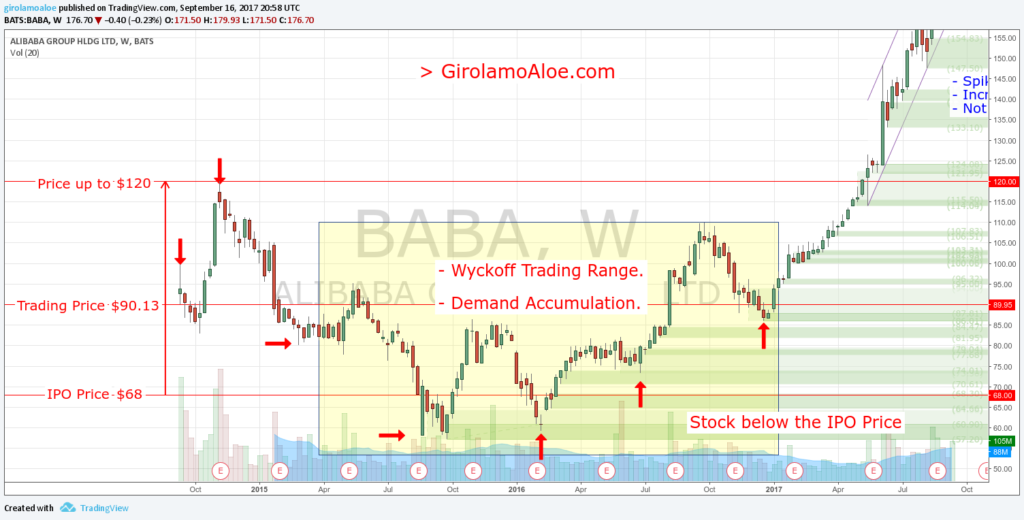

Alibaba Initial Public Offering Roadshow

Roberto Vilchis with his wonderful pictures, give us a way to see the deep importance of the Roadshow.

Alibaba invested a lot to enhance its public profile. Its investment made the Roadshow an engaging experience. Indeed, the Alibaba Initial Public Offering Roadshow gave confidence to the Institutional Investors.

The example of the Alibaba Roadshows helps you to recognize a concrete difficult.

The real problem is to make clear to the investors what the company is, how it works and what services it gives.

This is a challenge. The laziness of the Investors could make them not able to understand what the company makes. Besides, the investors could not have still a real interest to invest in the company.

Stimulate the interest of investors for an IPO is what Consultants and Agencies do.

BABA is the world’s largest-ever IPO on US Stock Exchanges.

Big thanks to Roberto Vilchis. He made a great job documenting Alibaba Initial Public Offering Roadshow. By his picture, I and you can realize the high relevance of the Roadshows for an Upcoming IPO in share market.

Imagination Agency Promoted the Alibaba’s Upcoming IPO in Share Market

According to Imagination, Alibaba wanted to enhance its international profile. For this purpose, the agency worked on branding and communication.

Alibaba with Imagination engaged the global institutional investors. The purpose was to communicate them the benefits of its services.

Imagination showed the “Alibaba’s e-commerce ecosystem”. It made clear the work and the role of the Alibaba Group, in a way appropriate for an IPO of this size, profile, and stature.

The agency assembled a global team from Hong Kong, New York, and London offices. This included Project managers, logistics managers and more.

Imagination managed the roadshows logistics for two large global roadshow teams.

These included also Alibaba senior management and colleagues from corporate finance. Besides, also R and PR/Corporate Comms teams and representatives of banking advisers.

From the other side, Imagination worked with Alibaba to communicate key messages. It enhanced the company profile involving people to the Alibaba Story at IPO events. To make so, the agency created and environmental branding and digital communications.

Two global roadshow teams visited 10 cities in the US, Asia, and the UK over two weeks.

IPOs for Everyone: The 12 Secrets of Investing in IPOs

A great book that will show you rules and secrets to invest in IPOs, comes from Renaissance Capital. This IPOs book is:

IPOs for Everyone: The 12 Secrets of Investing in IPOs.

The Founders of Renaissance Capital and IPO Aftermarket Fund wrote this amazing book. They started from their business experiences with IPOs.

Invest in the next upcoming IPO in share market was a privilege reserved for wall street pros. But now, there are many opportunities for small investors and retail traders. Everybody can take advantage of the IPO market.

The authors of IPOs for Everyone are Linda R. Killian, Kathleen Shelton Smith, and William K. Smith. They show how to look for the best buy in the IPO market.

IPOs have become a must-have for investors who wish to diversify their portfolio.

IPOs for Everyone reveals twelve secrets. They are the secrets used by the founders of Renaissance Capital. These secrets so as for best practices are fundamentals to pick a winning IPO investment.

Renaissance Capital is a leading IPO research and money management firm.

The book IPOs for Everyone gives the inside knowledge that investors must have. This knowledge is the know-how about how to earn in the volatile IPO market.

This includes:

- How to find the best companies.

- How to get a favorable price.

- The way to seek buying opportunities in the aftermarket.

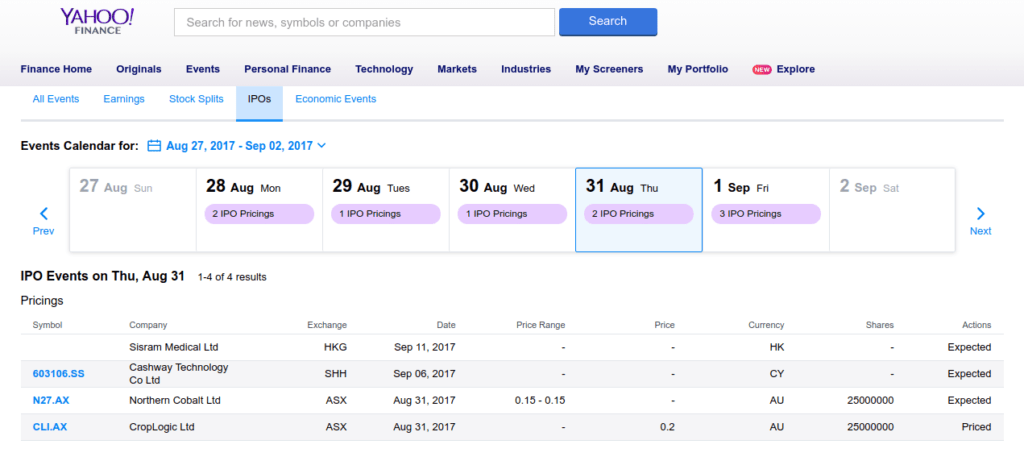

Visit the IPO Calendar to Find the Upcoming IPO in Share Market

There is an official IPO Calendar that includes any upcoming IPO in share market.

This upcoming IPO list is public and you can get it in the most important websites about Finance. For example Yahoo Finance.

Any IPO listing date, that is in the upcoming IPO list, comes from a specific stock exchange.

You can also go to the website of each specific stock exchange to look its own IPO calendar.

So, you can get upcoming IPO NYSE and upcoming IPO NASDAQ. You can also look for any upcoming IPO India if you want.

Besides, there is also an official calendar that shows the recent IPO of companies that are now public.

Have an IPO Calendar is useful for who invest in IPOs like institutional and retail traders.

The IPO Market is one the most important. There are Specific Investors, Investment Company Sections, and Traders which trade only IPOs.

You cannot ignore the Billions of Dollars that the IPO Market involves.

The investment actions occur in the Primary Market and later in the Secondary Market.

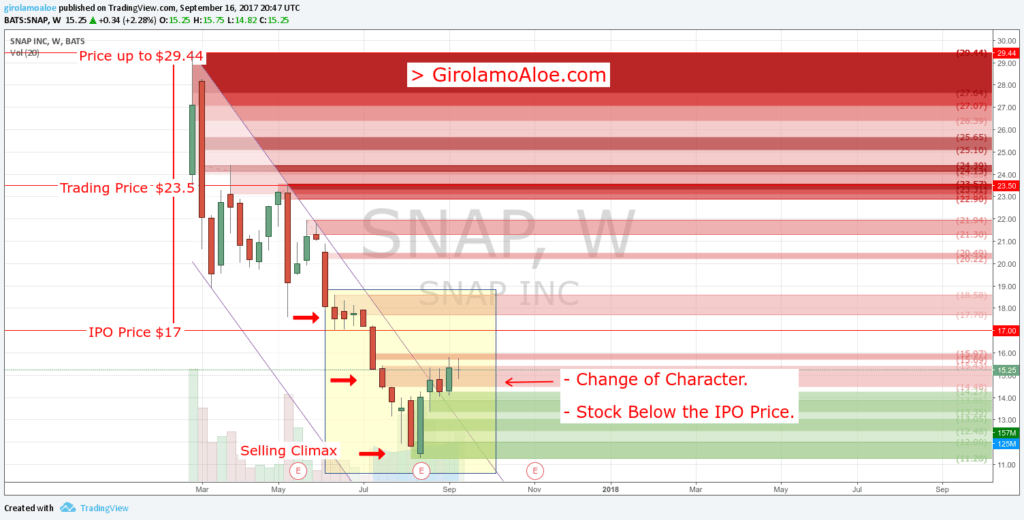

BABA and SNAP IPOs

I showed you the roadshow and other details about Alibaba and Snapchat IPOs.

Studying these cases, you can understand the value of their IPO and the solidity of the companies.

Alibaba Group Holding Limited and SnapChat Inc are both listed at NYSE.

BABA had the most impressive IPO Capitalization and its share price rose in a consistent way.

SNAP had a very high IPO Capitalization, but a few days later, the share price was below the IPO price.

These two IPOs are some of the most celebrated events at the New York Stock Exchange.

They are in an industry that was a trend at their IPO listing date. So, the demand in that industry was already high.

Besides, they have got pumped too, for two main reasons:

- Their industry is a trend. So their underwriters’ syndicate wanted to get more from the trending demand.

- Their underwriters’ syndicate wanted to induce a higher demand in the market for the IPO Sale.

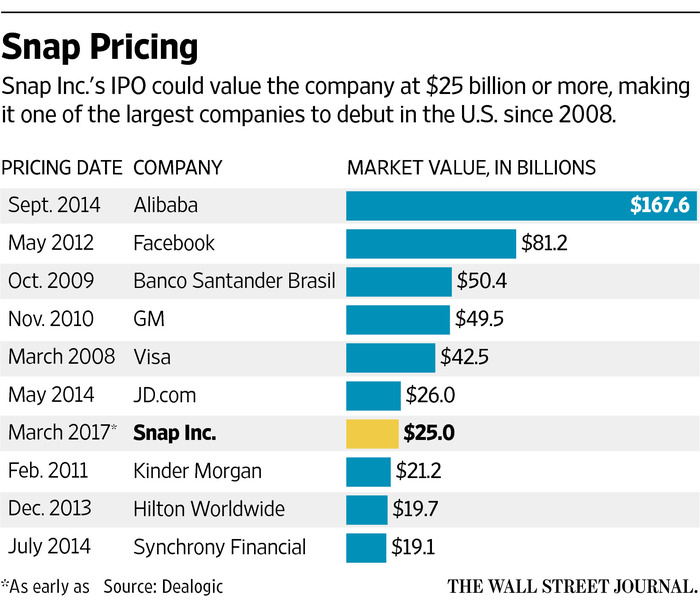

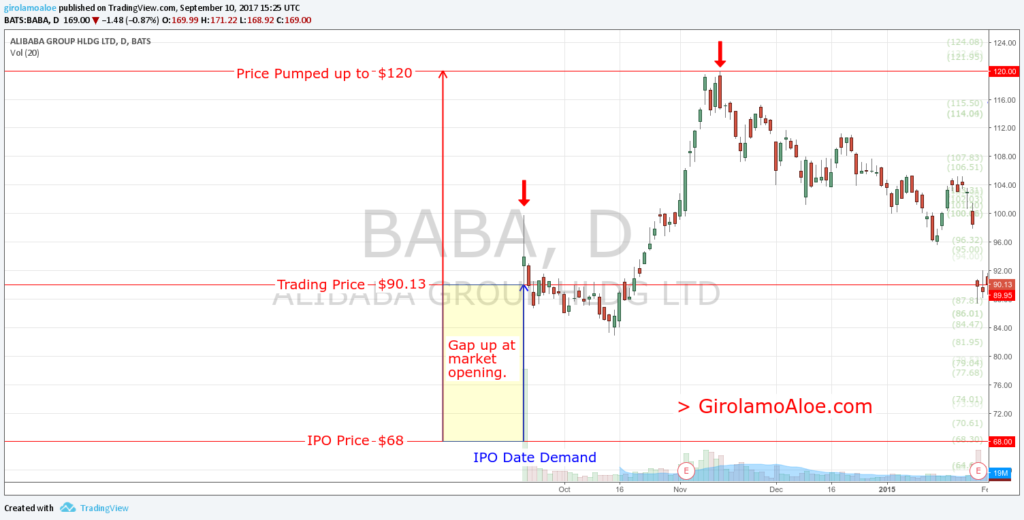

BABA Capitalization at the IPO Listing Date

According to Forbes and CBS News, for its upcoming IPO in share market, BABA went public at $68 per share.

At the IPO listing date, BABA and its selling shareholders raised $21.8 billion. Besides, underwriters exercised the option to buy more shares at the IPO price.

With $68 per share, at the IPO listing date, Alibaba has got an evaluation around $167.6 billion. One of the most valuable technology companies on the planet.

The stock jumped to $96.29, soaring 42 percent from the initial public offering price of $68 per share. By this, the Alibaba Capitalization jumped to $236 billion.

Alibaba IPO was a great success.

A few years later, the BABA share price continued to rise. This was possible also by the impressive earnings results of the company.

SNAP Capitalization at the IPO Listing Date

According to Forbes, for its upcoming IPO in share market, SNAP had a high Capitalization. Its Initial Public Offering was $17 per share, giving the company a valuation of $23.6 billion.

At the IPO listing date, SNAP rose $3.4 billion. It was the tech industry’s largest IPO since the BABA IPO in 2014.

The earlier market range was $14-$16 per share. But SNAP went public at $17. This means that underwriters felt that the investors’ demand was strong.

Before the IPO, Snap reported a net loss in 2016 of $515 million. It was higher than the net loss of $373 million of 2015. But Revenue increased from $58.7 million in 2014 to $404.5 million in 2016.

After a couple of days since the IPO listing date, the SNAP share price has fallen below the IPO price.

Pumped Upcoming IPO in Share Market

Marketability and Attractiveness are very important for companies who want to go public.

There are new IPOs every day. The New York Stock Exchange celebrates new IPOs at the Opening Bell and later at the Closing Bell.

The NYSE shares every IPO celebration on Instagram.

But, the most of the traders don’t care about any upcoming IPO in share market. They even don’t know about the IPO in the calendar.

This happens because there is a low promotion around the most of the new IPOs. The focus is almost only on the roadshow. Then, on investors that can have an interest in the company business and its industry.

These companies need to show Marketability and Attractiveness only to these big investors.

But for some upcoming IPO, Marketability, and Attractiveness get a high spread around.

These upcoming IPO in share market get a very high pumping by consultants or agencies.

But traders and investors need to consider what kind of companies are going public. For example:

- Companies with solid revenues and a solid business.

- Startups which are raising money for a project but almost no revenues.

- Solid Companies and Startups in an Industry that is a trend in the current IPO market.

So, you understand that there is a different risk in relation with the company that is going public.

To develop a high demand for the company, consultants and agencies contact the media. The purpose is the massive promotion of a new IPO.

This happens for some specific IPOs that are in a trend Industry.

Increasing the Demand Pumping the Upcoming IPO in Share Market

The Pumping of an Upcoming IPO in share market begins many weeks in advance.

You will see Bloomberg, CNBC, Reuters, CNN Money, Yahoo Finance and much more that begin to talk about the new IPO.

Going forward they will report details and data about the Roadshow. Besides, they will show possible investors and company founders that meet investors.

Media will continue in this way between Financial TV Shows and Newspapers. Then, on Social Media.

They will report also a possible IPO price for when the company will go public at the IPO listing date.

All this develops the interest for institutional investors and retail traders.

How to Make Money from IPO When It Is Pumped

By the Pumping, the new IPOs become upcoming hot IPOs.

At the IPO listing date, there will be a lot of people ready to buy the company shares in the Secondary Market.

The demand will be high, then the share price will spike up since the opening of the negotiations.

Knowing this, the risk to buy at the market opening becomes acceptable. Besides, in the most of the case, or even in all the case, this pays the trader with a large initial reward.

Then, for this case, you can set an order to execute at the market opening.

This makes sense for upcoming hot IPOs. But they are rare cases.

Any other upcoming IPO in share market doesn’t get the same pumping. So, the expectation for such companies can fail. In these cases, you must know everything you need about the companies. Such IPOs carries very high risk.

Brokers that let you trade shares, will have the IPO Ticker at the IPO listing date. This is possible because they provide the Stock Market Routes that include everything.

For example, Stock Market Routes like ISLD, ARCA, BATS, EDGE, CBSX, BTRD, OTC.

But brokers that let you trade CFDs have always a very limited offer. Then, they don’t offer to trade IPOs.

But, if an upcoming IPO in share market get a pumping and it is in a trend industry, they add the IPO ticker and promote it.

Retail Traders Have No Chance to Catch the IPO Price

Now you know that a pumped IPO can pay you a quick and large reward, in the short term.

But now, let me tell you what is the real problem with this.

When the company goes public there is no chance to enter the market at the IPO Price.

At the IPO price, there are two main problems for retail traders:

- Demand is too high.

- Brokers are not able to open the negotiations at the IPO Price.

This means that buying at the market opening, you will not be able to catch the IPO price. But, the execution of the order will happen at a higher price. Even at a very high price.

This means, that such gap up excludes the retail traders from the biggest part of the possible profit. But you will earn your profit from the IPO first day return.

Besides, if the company will go public at a very high price, your market price will be a lot higher.

You understand that your confidence about trading comes from the pumping of the IPO. Then, it comes from the demand and from industry trend.

The demand will be very high. This is the point of strength around your market order.

This is what will pay you that large and quick reward that you are looking for the IPO trading.

In such pumped upcoming IPO in share market, the reward you earn will make you happy. Even if the systemic circumstances don’t let you take the biggest slice of profit.

The Increase of Supply After the IPO Trading Time

The upcoming IPO in share market has now reached the end of the running. The company is now public and its shares are available in the Secondary Market. The company rose a new capital and now the shares can increase their price.

When the demand dominance at the IPO listing date gets exhausted after two or more days, the supply comes.

The distribution of securities can have different reasons. These can involve institutional investors strategies. Besides also shareowners from the company can increase the supply.

I want to show 2 conditions that cause the increase of supply:

- The Flipping IPO by big investors that realize the quick profit.

- The Lock-up Agreement between the Company and its employees.

What you know is that the pumping cannot persist for the long-term. Then, the stock will begin a consolidation so as it will start a dump.

When this happens the share price can also fall below the IPO price.

Flipping IPO Stocks

A company that goes public wants long-term investors who hold its stock in the portfolio.

The underwriters who bought shares from the company have to sell them. If they don’t sell them, they don’t earn the underwriting fee. So, they make initial large sales with big institutional investors by the roadshow.

Investopedia describes very well the IPO Flippers and the Flipping IPO Stocks Practice.

The Flipping IPO is the practice of big investors to buy low an upcoming hot IPO and sell shares in the first few days.

The IPO Flippers buy shares at the primary market and sell them in the secondary market. The purpose is the realization of a quick huge profit.

As I told you before, the opening price tends to become higher than the IPO price. Then, the big investors are happy to realize a profit in such easy way.

Flipping the IPO, the big investors distribute a lot of securities increasing the supply.

A reason for the Flipping IPO is that in the upcoming IPO in share market some investors didn’t get enough shares. Their allocation could be too low.

So, it doesn’t justify the management cost of their investments. Then, these institutional investors will love to realize the profit at market opening.

You must be aware that the Flipping IPO stocks are a practice that generates trading activity.

Even if the IPO Flippers make collapse the demand, without them there would be no stock for retailers. Besides even the secondary market could not exist.

A weak IPO shows later the falling of the stock below the IPO Price. This is so because the underwriters were not able to provide new buyers.

Not enough buyers were ready at a high price to take the shares distributed by the supply.

The underwriters have to balance the supply distribution. It is a necessity if they want to keep the stock above the IPO price.

Besides, underwriters can buy flipped shares to contrast an excessive falling.

Lock-up Agreement and Lock-up Period

When underwriters prepare the upcoming IPO in share market, they lock an amount of shares.

The underwriters prepare a Lock-up agreement that the company insiders have to sign.

The Lock-up agreement is a legal binding contract between underwriters and company insiders. It locks the selling of any share for a period of time.

Key employees receive company shares. Get shares is a way to earn money. Then, many employees want to cash their shares as soon as possible.

But signing a Lock-up agreement, they accept to don’t sell their shares for a Lock-up period.

The purpose of the Lock-up period is to avoid the falling of the price by the selling at market opening.

For the upcoming IPO in share market, the Lock-up period helps to stabilize the stock price.

At the market opening, the price is higher than the IPO price. This gives a high reward to shareholders. So if the company insiders sell shares at market opening, the supply would collapse the price.

Besides, underwriters want outside investors to believe to data they provided. Selling their shares, company insiders show that the business is not worth enough. This compromise the IPO first day performance by the increase of supply.

The Lock-up Period will expire. Then, company insiders will be free to sell their shares at the end of the Lock-up Period.

The SEC Rule 144 defines the duration of the Lock-up Period. The SEC Rule 144 regulates the selling of restricted securities. The Lock-up Period duration ranges from 3 months to 24 months.

When the Lock-up period will expire, company insiders will cash their shares. This will increase the supply and the result will be visible on the chart by the falling of the price. Often, the supply could drop the price below the IPO price.

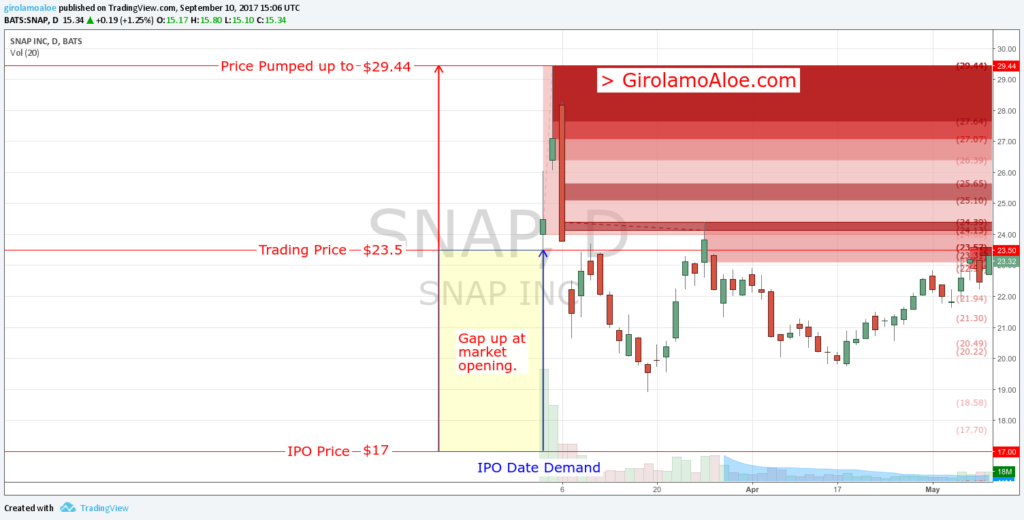

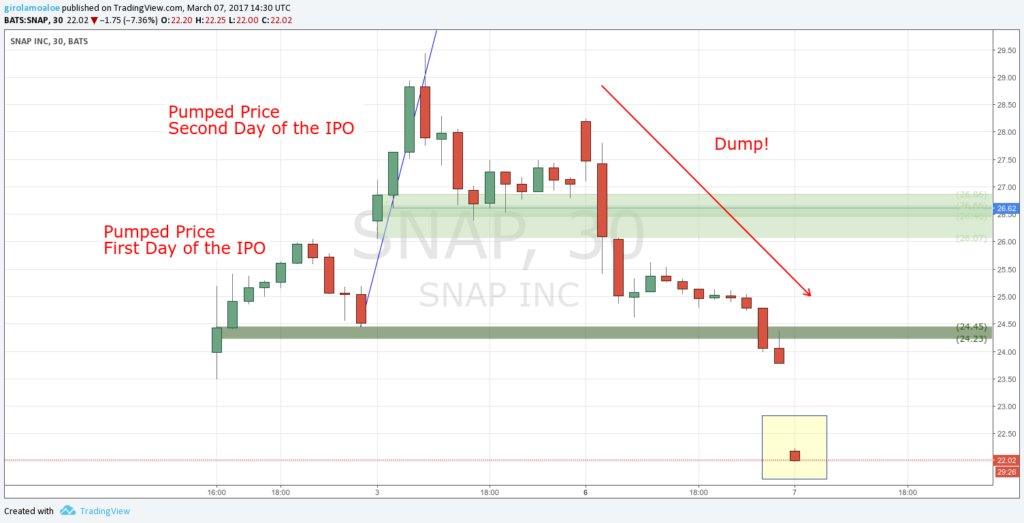

Flipping IPO Stocks, the Case of SNAP

The SNAP IPO Sale is a great example of Flipping IPO Stocks.

The SNAP Upcoming IPO in share market rose a lot of money for the new capitalization. The roadshow was very productive for this trendy company.

But, the company didn’t show a solid business. SNAP is a trendy business in a trendy industry. But it is still not so much attractive. Then, many institutional investors realized the profit in the first 2 days of the IPO running.

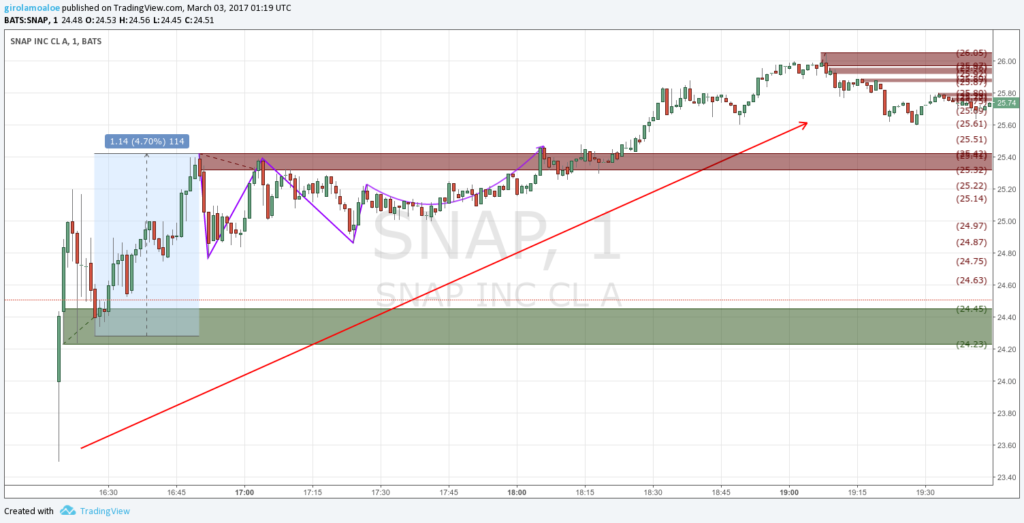

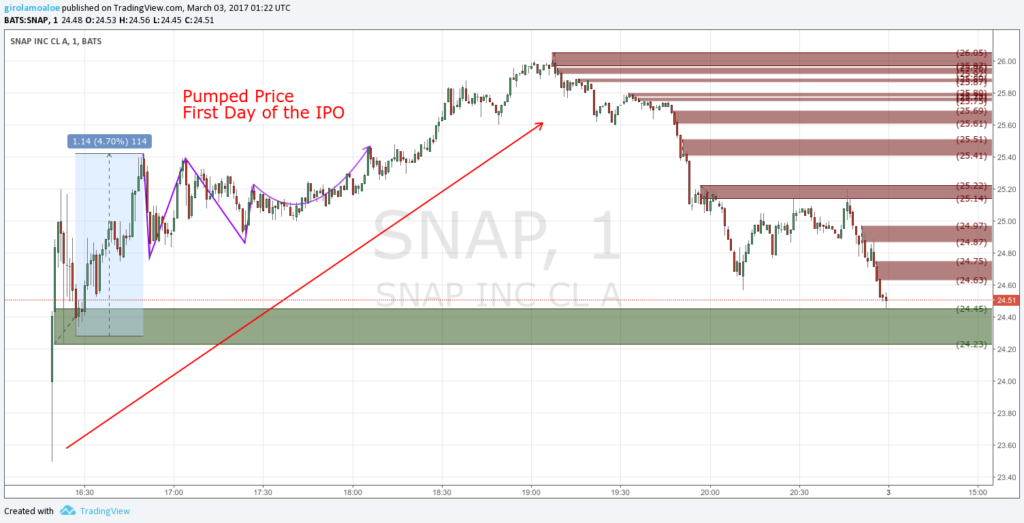

You see the first massive sale in the IPO listing date.

The IPO price was $17 per share. Instead, at the market opening, the price spiked to $23.5 per share.

This is a very good reward for a quick profit. I am talking about a profit of $6.5 per share. That is Great!

In the IPO Day, the demand pushed to the price to $26.05.

Later, the first sales dropped the price from $26.05 to $24.45 reaching the first demand.

Those investors who realized the profit are the ones with no real interest to hold their shares. For the most of the case, this happens because they didn’t get enough shares during the roadshow.

In the Second Day of negotiations, the demand rose the price to $29.44 getting a Buying Climax.

The institutional investors took a very quick and very profitable reward, increasing the supply.

Making so, these institutional investors flipped the IPO. So, SNAP started the dumping.

Later it has become uncertain and the stock fell below the IPO Price.

But, as you already know, some investors work in this way having the plan to buy later at a lower price. Then, at the right time, they begin the accumulation of securities to hold for the long-term.

Contrasting the Flipping IPO Stocks

There is no regulation that contrasts the IPO Flippers.

Preparing the upcoming IPO in share market the underwriters estimate the flipping. Besides they need to make an active monitoring to the activity of the IPO Flippers.

An important support comes from two sources:

- Depository Trust & Clearing Corporation (DTCC).

- Brokerage Guidelines and Limitations.

The Depository Trust & Clearing Corporation (DTCC) monitors the stocks after the IPO. It reports to the underwriters if their clients sold or are selling shares.

Underwriters base their offer to institutional investors also on trading expectation. So if an investor flips the IPO, it will get penalized for any future upcoming IPO in share market.

Investors need to inform and discuss the selling in advance, with the underwriters. In this way, they don’t jeopardize future opportunities.

The brokerage firm can get only a limited allocation of shares. Then, it allows the trading of the IPO shares only to very active traders with big resources. This is also an imposition of the regulators.

Besides, the broker informs such customers that sell in the first weeks is flipping. So, selling the shares too soon will penalize these customers. They will risk a ban for the trading of the next IPOs.

Market Opening and Broker Opening at the IPO Secondary Market

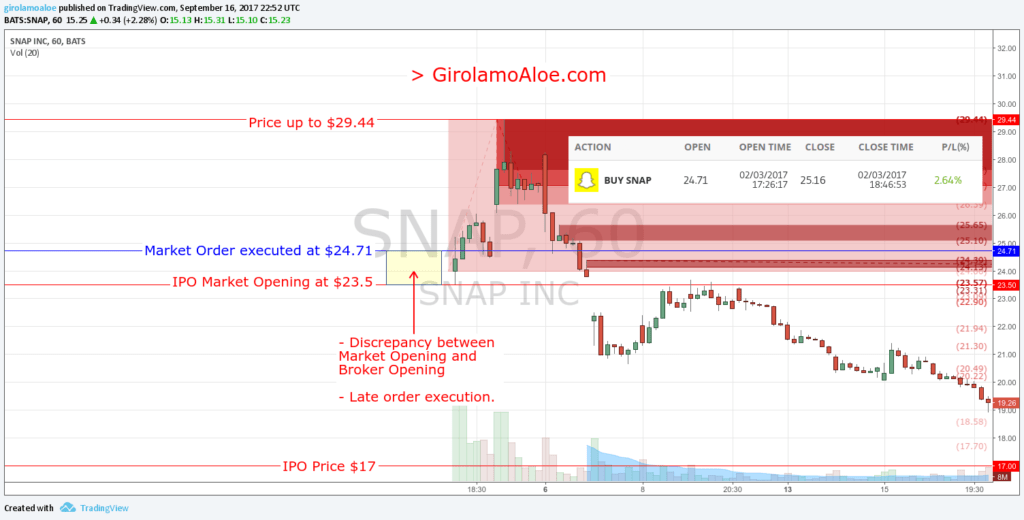

I bought SNAP in the IPO listing date and I cashed my IPO first day return.

I had set my order to get executed at the market opening. The order execution was at a crazy high price.

The IPO market opens higher than the IPO Price. But you have also to consider that the Broker opens the negotiations even higher. This means that your order gets a late execution.

The high demand, the market opening and the broker affects the execution of the order. This is inevitable. Blame the broker for the late execution of the order is pointless.

But the profit that you get, in that little part of the rising, after the market opening, will make you happy.

Buying at the IPO Listing Date Don’t Hold Shares for the Long-Term

Don’t think to buy and hold when the IPO reaches the secondary market. It would become only a big damage for your balance account.

You are a retail trader. You are not an institutional investor. So, be careful.

After the IPO day, the IPO Flippers will increase the Supply. It will absorb the demand making fall the price.

Then, it makes no sense to buy at such high price to hold the shares for the long term. It’s craziness. It will eat your balance account.

You want only the quick and big profit, riding the high demand at the first and second day of the IPO.

Then, you realize your profit and later you wait for days, weeks, months. This means that you are going to wait until the Flipping IPO makes fall the stock below the IPO Price.

Buy and Hold Shares at the End of the Wyckoff Trading Range

After the Flipping IPO, you let fall the price waiting with patience for the Selling Climax. Then, you wait that the Composite Man develops the reversing of the trend.

At the end of the Wyckoff Trading Range, the Composite Man will have enough securities. Then, the Demand Accumulation will absorb the remained supply starting the markup.

When this happens, you want to be there with your buy trades holding shares for the middle and long-term.

Then, you add in your portfolio a stock bought at a very favorable price, according to the Wyckoff Trading Range. From this, you can get only a lot of advantages in money.

Conclusion

IPO Roadshow, Demand Pumping, High Price at the IPO market opening, Flipping IPO Stocks. All these things are parts of a big running.

This running is a big game to prepare an upcoming IPO is share market going to take all the benefits of buying IPO.

The purpose of such hard, long and big IPO game is the money. Money for everybody.

Money for the company capitalization and money for the institutional investors. Besides, money for the third party companies that work around the IPO. Last but not least, also that slice of the money that retail traders can put in their pocket trading the IPO.

You are now able to recognize the benefits of buying IPO. Of course, only for those rare cases where the IPO is under a pumping to increase the demand.

To learn more about the Initial Public Offering process and the advantages for investors and traders read this book:

IPOs for Everyone: The 12 Secrets of Investing in IPOs.

It will give you a lot of help.

You will get the knowledge you need about the IPO market and to operate like an investor and a retailer. This know-how will make you able to earn in the volatile IPO market.

You and I want to get this knowledge because we want to take our slice of the big money that run around in the IPO Listing Date.

If you were a member of Profiting.Me when I took my profit on SNAP in the IPO Day, you learned the logic around my buy trade. Study Guys.

Let me ask you a question:

Did you ever buy a Pumped Upcoming IPO in Share Market? What was your trading experience?

Rorisang Kole says

Nice article, really informative.

Girolamo Aloe says

Yes. It is really helpful for who loves the IPO niche. It shows the IPO Process. Besides, the roadshow of BABA and SNAP, their charts, their price behavior after the IPO and more.

It was a long work 🙂

Soon, I will begin the next blog post. 😉