One of the most common difficulties in the Trading Practice is the Trading Position Sizing. Whether you invest in Stocks or Forex, the problem is the same: How much invest? Define a good Position Size makes easier have clear the risk and define a proper Risk Reward Ratio.

The choice of the amount to invest and the acceptable risk are totally arbitrary. There are so many ways to define risk and volume for each trade. Everybody defines the Position Size as he prefers. What I want show in this post is just an example of Trading Sizing based on a systematic use of the Fibonacci Series.

Why Fibonacci Series to define the Position Size?

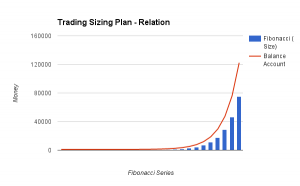

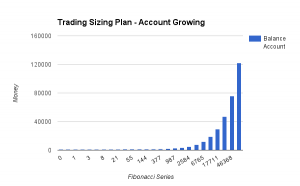

The Fibonacci Series gives a specific schema for Trading Sizing. This means that the Trading Volume follows a non-linear series with a natural setting that is able to make grow the Account properly and quickly.

The Fibonacci Series makes the Trading Sizing very easy, giving a way to set a long-term Trading Position Sizing Plan.

How to Plan the Trading Sizing using Fibonacci?

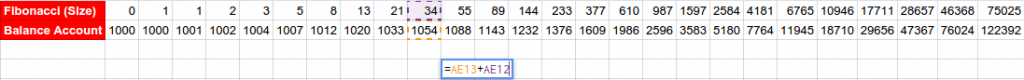

A long-term Trading Sizing Plan follows the Fibonacci Numbers. The increasing of the Trading Volume happens in accord with a specific growing of the account.

For example, a trader can set to increase the Position Size from a Fibonacci Number to next one of the Series if he has earned an amount of money that could be equal and the Position Size used. This is not a rule, it is just an example of Trading Sizing Strategy.

In the same way a trader can decide to cut the Position Sizing to the previous Fibonacci Number of the series, in the case he doesn’t feel ready to trade with the Position Size used or if he has experienced an excess of losses.

The choice is totally arbitrary, but if a trader wants be disciplined (this is a need in trading) the best practice is make a Trading Sizing Plan and Respect it in the best way he can.

Degrees of Risk for each Trading Position Size

The Position Size can become a big limitation. The solution to manage this problem is the Risk Management and the opportunity that many brokers give to set Leverage and Stop Loss Limit.

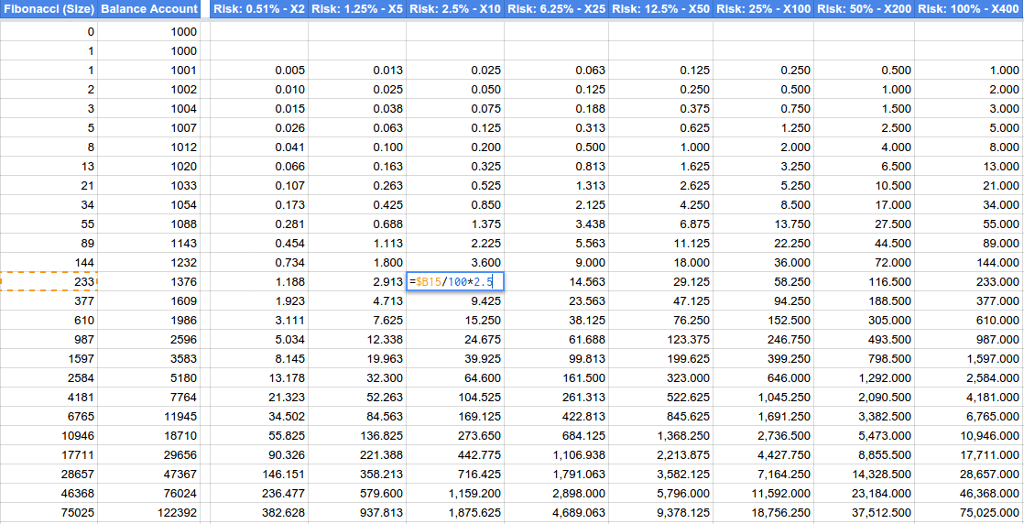

Example of Trading Sizing Plan based on the Fibonacci Series

The table reports the predefined Risk Margins per Position Size (cut losses quickly), in accord with the Leverage and the Percentage of acceptable loss for a trade (On the top of each column there is Risk and Leverage).

The Risk per Trade used to define this table has an indicative and not absolute Stop Loss of 25 pips. it defines the plan, but it changes with the currency to trade. It is not a rule, so a trader can use what he prefers.

Risk Margin per Trade

Every trader trades in his own way. Many traders use to consider the risk around a specific support/resistance, or defining the acceptable loss trade by trade. What I describe here is just an example of many used to set the Risk per Trade.

Considering that there is no sense to risk more of what is an acceptable earning for a specific trade, a good practice is define the greatest loss as percentage of the amount invested.

For example, investing $1000 in a trade, the acceptable loss could be 2%, 20% or other considering the desired risk. The 2% could be a margin of 25 pips with a specific leverage or also a margin of 50 pips with another leverage and so on.

If a trader consider to don’t lose more of the 2% per trade, his Trading Sizing Plan has to report the Risk Margin.

Degrees of Freedom for Position Size – Leverage for Risk Margin

The Leverage can give good Degrees of freedom for a Position Size. The Fibonacci Series gives the Amount to invest and the Leverage lets set the desired Trading Risk.

For example, investing $1000 in a trade and accepting a loss of 2%, 20% or more, the leverage makes you define the risk, considering that there is no sense to risk more of the expected earning.

Using a leverage X5 the risk could be 1.25%. Using the Leverage X10 the Risk limit can reach 2.5%. But this is not a rule, it is just an Example.

Conclusion

The Trading Sizing Plan is a positive thing. It helps with the discipline and to keep under control the Risk. The use of Fibonacci is simply a choice. A trader could be agree with it or not. But it is a good example of how define the sizing to make grow the account, considering also the predefined Risk Margins for Leverage reported in the plan.

I reported here a very easy example of Risk Management that can help any trader to manage the Trading Volume, just keeping the focus on his Trading Position Sizing Plan.

If you want to share your opinion about “how to make a Trading Sizing Plan” or simply tell what you think about the example described in this post, please add a comment.

If you Like this post, please share it with your friend.

Leave a Reply