A Good Review of Trading Mistakes is an important part of the trading experience. It helps to understand what is wrong and why. Then it is a good way to improve the trading practice and make money better than before.

May 1, 2015 GBPUSD moved down from 1.5396 to 1.5114, enough quickly.

I was late, I was sleeping, then I was not able to catch the selling opportunity. So, my plan was just to Buy the Overextended Chart in the dip, in the potential Parabolic Pattern Rotation.

Changing the Trading Approach

In the last weeks I took in consideration the possibility to explore new ways for my trading that can help me to cut the percentage of trades closed with losses. In the same way, to get more advantages that can show me more profitable trading opportunities.

In practice, I love Price Action Trading, with naked Charts. But I want to make more money, in day trading. So, I started to Study some popular Trading Indicators, like RSI, MACD, Stochastic.

Until now I have always preferred to follow resistances and supports on the chart, without indicators or oscillators. This is really good for who trades the daily chart or higher. This means also that is easier stay focused on trades that run for the middle term or long-term.

At the moment, I am not so much interested to specialize myself in long-term trading. And also, I don’t want to carry over the night or over the weekend my trades opened, if it is not necessary. Especially if they are not running in profit.

I want to specialize myself in day trading.

May 1, 2015 – Trading Mistakes on GBPUSD

Changing the Trading Approach is not always easy. The transition, can have a cost by trading mistakes.

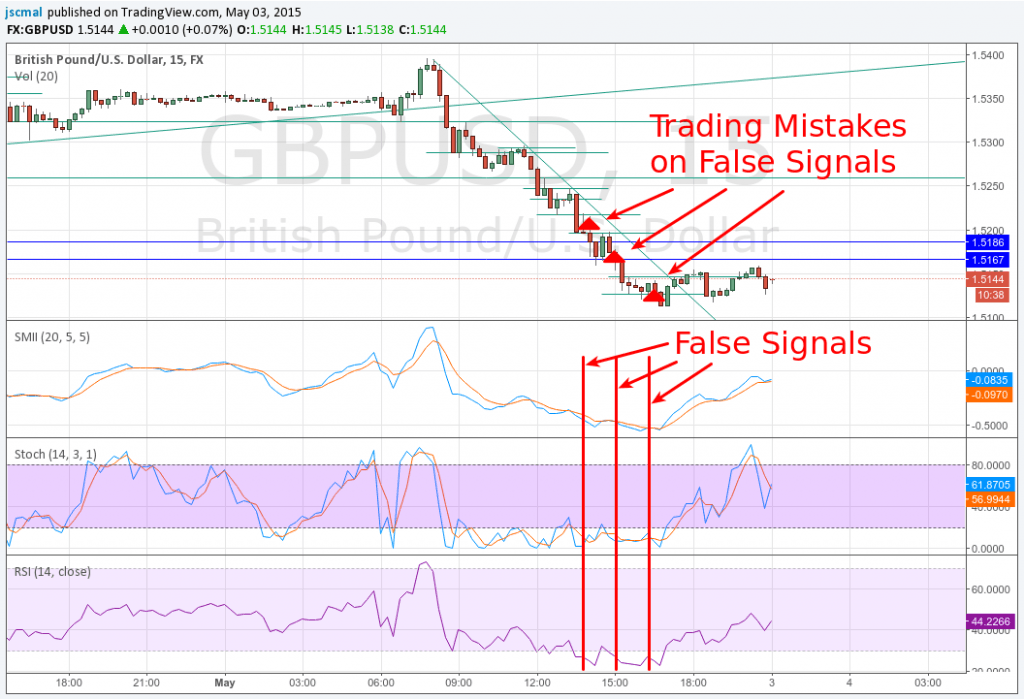

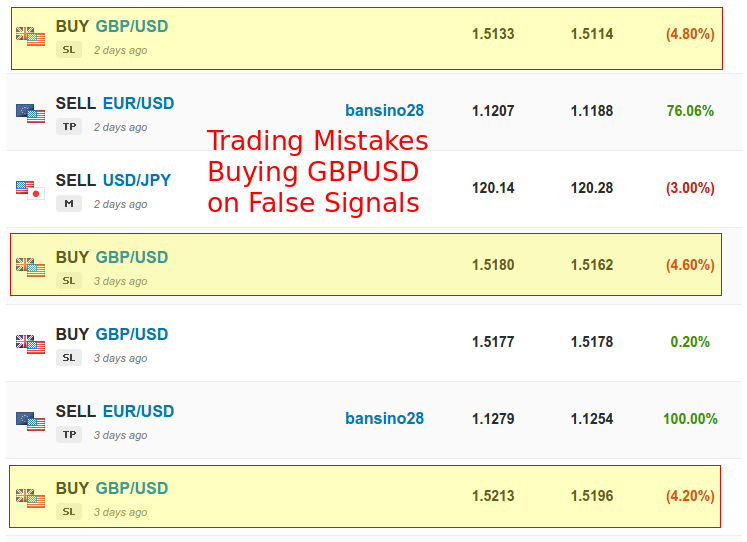

In this specific case, my mistakes were just to have anticipated the Parabolic Rotation following False Signals.

I triggered my trades during the false signals. Generally I wait a clear rotation in an overextended chart. But in this case I waited the waves convergence in the indicators.

The result that I had just what I tried to avoid.

I watched the 15 minutes Time Frame and this was a mistake.

The Trading Tools that I was testing in that moment were:

- Stochastic Momentum Index Indicator (SMII)

- Stochastic Oscillator (Stoch)

- Relative Strength Index (RSI)

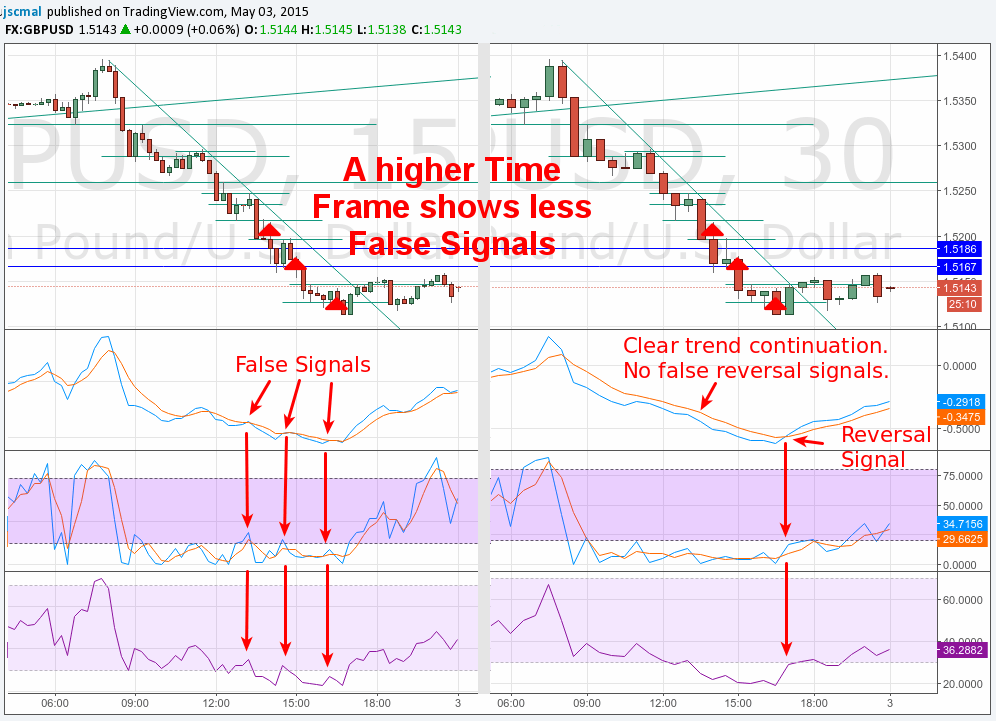

How to avoid most False Signals?

The best way to avoid the false signals is just watch the behavior of a Financial Instrument in several time frames, considering that

Higher Time Frames cut the False Signals.

In the same way, it is good to use indicators well refined, in this way there will be less false signals.

For people who wrongly think that make trading using indicators is a good thing, the best recommendation is just to use only a few number of indicators and to don’t abandon the trading approach based on Price Action.

Leave a Reply