There are many Forex Trading Success Stories. How many of them care about the use of the Stop Loss? How newbies and experienced traders care about the Stop Loss? Do you care about the Risk Reward? Do you trade having a Trading Plan? Or you invest because people tell you where to buy or sell?

One of the most dedicated members of Profiting.Me asked an important question to me. I wish him to live one of those Forex Trading Success Stories that can inspire every trader.

In his email, he said:

“I usually prefer stop loss of not more than 60 pips per trade and from time to time I will go for 80 pip. What I have realized with this approach is that I sometimes miss opportunities. So the advice I wanted to know was:

Should I stop to focus on stop loss pips and instead focus more on opportunities?”

This was an interesting question because the use of the Stop Loss is the Dilemma of newbies.

As first thing, you have to understand that I cannot tell you how to manage your trades. In the same way, I cannot tell you how to manage your money. Everybody manage their trades in the way they prefer.

But, there is one relevant thing that everybody needs to understand to manage trades in a proper way. It is the importance that you put on your Position Management.

This is common to all the Forex Trading Success Stories you see in the world.

Many newbie traders confuse the Position Management with the Trading Plan. This is a bad mistake that is very common.

Plan Your Trades Knowing How Much They Are Going to Cost

You should not limit your view to only one trade. Instead, You MUST consider the opportunities that the Trading Scenario is offering you.

Then, the managing of your trades must be according to the Trading Scenario where you going to invest.

Every Newbie Trader miss to ask himself a simple question:

“How much money is going to cost the trade that I am going to take?”

The number of pips you set your stop loss is not the most important thing.

You should focus on the Commission Cost of each trade you are going to take in the Trading Scenario.

So, you try to make an evaluation of the cost per trade. In this way, you see if the cost of your trades in a Trade Scenario is acceptable for you.

You MUST Think Bigger. Get a view that is bigger than the one you can have staying focused on a single trade.

Do you have a Trading Plan for a Trading Scenario?

Or you look for that one trade you can take in that moment, without considering the whole Trading Scenario?

If you have a Trading Plan you know what you are going to do. Then, you can hold one or more trades in red according to the plan.

With a Trading Plan for your trades, your story could become one of the Forex trading success stories.

What is relevant is how much these trades are going to cost before they give you a profit.

In the same way, how much the cost per trade can affect those trades you are going to close with an acceptable loss.

Commissions Costs can become very dangerous if you skip to measure them for your trades.

Why the Stop Loss is the Dilemma of Newbie Traders

When you are a newbie, you learn to use the Stop Loss with Risk Reward 1:3 or something similar.

The main reason is that the most of the pieces of information you get around in an easy way, are only for newbies.

They come from people who get paid to write them. In the same way, they come from those who are not profitable by trading.

To get the right tips about trading, you have to search specific topics. You have to look for that kind of info that only currency trading millionaires can give.

Successful Forex traders, even those you ask suggestions, would not tell you to don’t use the Stop Loss. In the same way, they will not give clear or detailed suggestions to use the Stop Loss in a specific way.

Let me be clear:

An expert trader cannot tell to newbies to don’t use the Stop Loss because this has consequences. Newbies are not expert traders. They lose money.

Newbie traders, alone, have high chances to fail with or without the Stop Loss.

A newbie trader takes a trade. This trade turns to red showing several pips of loss. Then, he gets panic, without know what to do. So, he looks for somebody to blame. It is so.

It is an emotional involvement.

A newbie trader takes months or even years to get experienced enough to manage his feelings in a proper way.

Indeed, to become able to trade in the right way, he needs to practice for the long-term.

Besides, he will get a big help by the use of a sizing plan to support a sustainable growth.

The Truth About Successful Retail Forex Traders and Stocks Traders

Now you should listen very well to what I am going to tell you.

If you want to learn how to earn money by trading in a proper way, you should not stay in the same room with newbies.

I know this could sound not good to your ears. But this is the way. This is the TRUTH.

Who wants to earn money in the right way, doesn’t want to listen to obvious things. In the same way, he doesn’t want to listen to inconsistent topics, by inexperienced people like him.

And more, you should not debate about trading with newbies.

Besides, you should not take advice from who writes content for newbies.

For sure, you have not to listen to who earns by affiliations and trading signals. In the same way, don’t listen to advice from Broker Account Managers and Bank Account Managers.

Take money advice only from who was already able to earn money by trading in a proper way. Period.

Who Was Able to Earn Millions Will Show You How to Become a Millionaire

I tell you a story, a little fragment of my story:

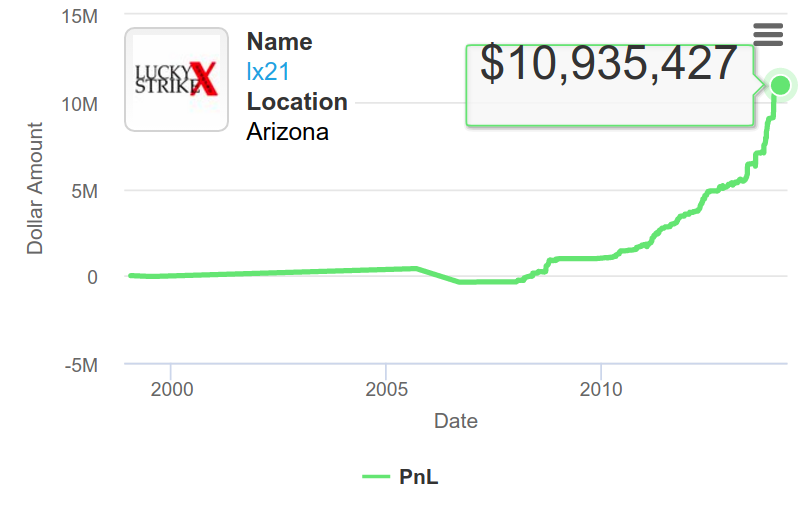

When I found the mentor who changed my way to approach trading, he had passed 4 Million in that moment. Around him, I have found other millionaire traders that had become my mentors too. One of them was reaching 2 Million in that moment. Others were reaching their First Million.

But a couple of them were on the extreme of 10 Million.

I show you the Account Growing of one of the traders who inspired me for years:

The veteran stock trader Gregg Sciabica, in 2014 passed the 10 Millions of his life profit. Later, he started his private hedge fund. For this reason, now his results are not more public.

Ironically, being less confident can be a positive thing. people who are overconfident tend to trust their intuition too much. – Gregg Sciabica

What I am telling you is that if you want valuable tips about money and trading, don’t lose time with who is not able to earn.

You should not spend your time with people and communities that cannot help you to improve.

Instead, stay around of successful Forex traders in the world. Take the best from them.

This is what you MUST do. You will pay for their knowledge and expertise. In return, you get the growing of your skills and the improving of your profitability.

This is the way to turn your personal story to one of those Forex Trading Success Stories that inspire you.

An Expert Trader Knows That a Trading Plan Is Crucial for His Profitability

An expert trader knows that, in general, about the ~90% of the trades he is going to take will get a wrong entry.

There is no way to get a 100% of perfect trades. NO WAY.

Even a Quantitative Trader cannot develop algorithms to execute only perfect trades.

For example, you open one perfect trade, but before of it (or later of it), you could take 10 trades or more with a wrong entry.

An expert trader turns this into an advantage because such circumstance is part of his Trading Plan.

The expert trader has a Trading Plan for his profitability in a Trading Scenario. This can involve several trades so as several entries.

The Trading Plan is a crucial resource about how a group of trades in a Trading Scenario, are going to pay.

How many Forex Trading Success Stories do you know, who cares about the Stop Loss around one trade only?

I am not talking about YouTuber traders who tell you to set your stop loss and buy their services.

I am talking about Forex millionaire stories. At least, one real Forex millionaire that you can know.

There are many Forex true stories of success so as many Forex failure stories.

Only Forex millionaires so as Forex billionaires can tell you how to earn millions in the Forex Market.

Nobody of them takes care of the stop loss per trade. They keep the focus on the Trading Scenario where they are going to invest. Their risk depends on the Trading Scenario.

One of my millionaire mentors, a stock trader, uses to repeat:

“If you don’t have a plan, you don’t have a trade.” ~ Nathan Michaud

Why a Forex Millionaire Strategy Doesn’t Limit the Risk to a Single Trade

If you stay focused on only one trade, you have a limited “view” about your options. This doesn’t favor your profitability in the short, middle, and long-term.

Talking about the 60 pips of Stop Loss indicated by my student, I can show you the missing of profitability.

You take 10 trades or more. All them with a Stop Loss of 60 pips. You could get 1 of them at a perfect entry.

Going forward, you will realize that they are not making grow your account balance. The reason is that the most of them will hit the Stop Loss and others will get a small profit.

This happens because your focus was on the Stop Loss of 60 pips, missing the whole Trading Scenario.

If you limit the Stop Loss trade by trade, you are limiting your Profitability to the risk carried by each trade.

It causes a choppy behavior in your balance account. Besides, you are missing the reward of the whole Trading Scenario.

In practice, by all those trades that hit the Stop Loss, you are fighting to keep up the growth.

Indeed, if ~90% of trades can have a wrong entry, there is a high chance that only a few of them will give a satisfying reward. So, the balance account could not get a real growth by them.

The result is that you will spend weeks to recover all those losses, adding new mistakes.

But your focus will continue to stay on the Stop Loss per trade and on the losses to recover. Your focus will not be on the Account Growth.

Then, you will experience a perennial frustration caused by a wrong use of the Stop Loss.

Instead, you must focus on the growth since the beginning.

Forex Trading Success Stories That Can Inspire You

What inspired me in life can inspire you today and forever. I am a trader because I wanted to become a Trader.

But before than this, I found out about trading when I was in high school. When I was a teen there were not the tools we have today for trading. So, Financial Markets were more for rich people with specific intermediaries.

Today, everything is easy and people like me can earn money staying at home or everywhere in the world.

Trading has become more a “Software Developing Business for Finance” than a pure Financial Business. Of course, the purpose of the coding is to earn more money in a systematic way, by specific algorithms.

The Forex success stories that inspired me are very old. Behind them, there are people who were able to earn consistent money from Forex Market.

The difference between Successful Traders and who rejects the idea to invest on Forex is the perception of the business.

People, who reject Financial Markets including Forex are those who ask: “is Forex real?”

So, let me show you the most important and rich Forex trading true stories.

Would you like to get your story and your name added to the list of the Forex trading success stories?

In only one post, I am going to talk about a limited number successful Forex traders stories. Only 3. But there are many more forex trading true stories that you can explore by yourself.

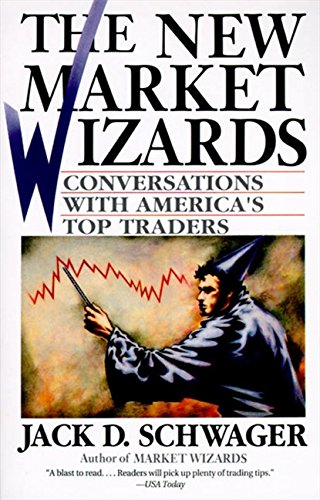

I want to start introducing you a famous book that will inspire you by passion, traders wisdom and experiences.

The New Market Wizards: Conversations with America’s Top Traders

In The New Market Wizards, successful traders relate the financial strategies that have rocketed them to success. Jack D. Schwager encourages these financial wizards to share their insights. He asks them questions that readers with an interest or involvement in the financial markets would love to pose to the financial superstars.

The New Market Wizards is another Schwager classic, informative, and invaluable.

As in the previous volume, Schwager starts with a frank discussion of his own trading experience, followed by a surprising diversion comparing Saddam Hussein’s invasion of Kuwait with a trade that went wrong.

The rest of the book is broken into five parts. It includes several interviews with different types of traders and brief discussions of the lessons to be learned from them. It has a part on trading psychology. Besides, it includes a final part summarising the wisdom gained from all of the interviewees in 42 golden rules.

George Soros

Founder, Soros Fund Management LLC

George Soros founded the Soros Fund Management in 1962. The company gained tens of billion dollars over the years.

I already talked about George Soros and his partnership with Jim Rogers. They founded the Quantum Group of Funds in 1973.

George Soros has got an international fame on September 16, 1992. It was the Black Wednesday. The Quantum Groups earned $1 Billion in net by short selling an amount of 10 billion pounds sterling.

For this reason, George Soros holds the record of being the first person to get the highest earning in a single day.

At that time, Britain was part of the Exchange Rate Mechanism (ERM). The UK government had to hold the pound over a certain level against the Deutsche Mark to stay in the ERM.

But, on September 16, 1992, the Pound Sterling was not more able to stay above the lowest agreed limit. So, UK had to withdraw the Pound Sterling from the ERM.

This short sell made him famous. In that moment George Soros became:

“The Man who broke the Bank of England.”

His story deserves to stay on the Top of the Forex Trading Success Stories.

According to what Forbes reported:

George Soros is one of the largest supporters of drug reforms. For example, to use some drugs for medical purpose. His foundation donated about $200 million to drug reforms, since 1994.

Ethan Nadelmann, Drug Policy Alliance, said:

“He’s played a historic role in the evolution of drug policy reform from a movement that was on the fringe of U.S. politics to one that is in the mainstream.”

Stanley Druckenmiller

Founder, Duquesne Family Office

Stanley Druckenmiller worked at the Quantum Fund for more than a decade. He worked alongside with George Soros enough to consider him his mentor.

But Stanley Druckenmiller established his solid reputation with his Duquesne Capital Fund, before retiring.

Stanley Druckenmiller affirmed that his trading philosophy revolves around the preserving capital.

His work is the building of long-term returns. Then, it is the pursuing of profits, in an aggressive way, when trades are going well.

This approach emphasizes the value of maximizing the opportunity when you are right. Then of minimizing the damage when you are wrong.

Indeed, it downplays the importance of being right or wrong.

During an interview for the famous book “The New Market Wizards“, Stanley Druckenmiller said:

“There are a lot of shoes on the shelf. Wear only the ones that fit.”

A the end of the 1980s, the German Mark was suffering a constant depreciation. The serious situation around the reunification of Germany undervalued the German Mark.

Understanding such undervaluation, Stanley Druckenmiller saw an opportunity for purchasing.

At the beginning, he placed a multi million long position in German Marks. Later George Soros made him increase his position adding 2 billion German Marks.

The return was a 60% earnings for the Quantum Fund.

Stanley Druckenmiller learned a lot working with George Soros. His story deserves to stay in the list of the Forex Trading Success Stories.

Bill Lipschutz

Co-founder and Director of Portfolio Management at Hathersage Capital Management.

Bill Lipschutz turned the $12000 he inherited from his grandmother, into $250000.

But later he lost everything by bad personal investment decisions. By this loss, he realized the importance to work having a proper risk management.

In 1982, Bill Lipschutz attended the Salomon Brothers investment company training program.

In 1984, Salomon Brothers offered him to join a new department dedicated to the Forex Market. The intention of the company was to develop its business in the growing Forex Market.

Bill Lipschutz made hundreds of millions at the Forex division of Salomon Brothers. Earnings like $300 million dollars per year.

In the 1980s, such return per year was a lot of money for a growing market like Forex.

For this reason, Bill Lipschutz became:

“The Sultan of Currencies.”

Bill Lipschutz describes Forex as a very psychological market.

The market perceptions help determine price action as much as pure fundamentals.

Bill Lipschutz also agrees with Stanley Druckenmiller about trading on Forex:

How to be a successful trader in Forex, is not dependent on being right more often than you are wrong. Instead, you need to understand how to make money when you are right only from 20 to 30 percent of the times.

Bill Lipschutz empathizes the need to manage the risk explaining an important thing:

You should choose a trading size that avoids the forcing out of your position when your timing is inexact.

He made himself from scratch. he made hundreds of millions without a real background of experiences.

His story deserves to stay in the list of the Forex Trading Success Stories.

Understanding Risk and Opportunities in a Trading Scenario

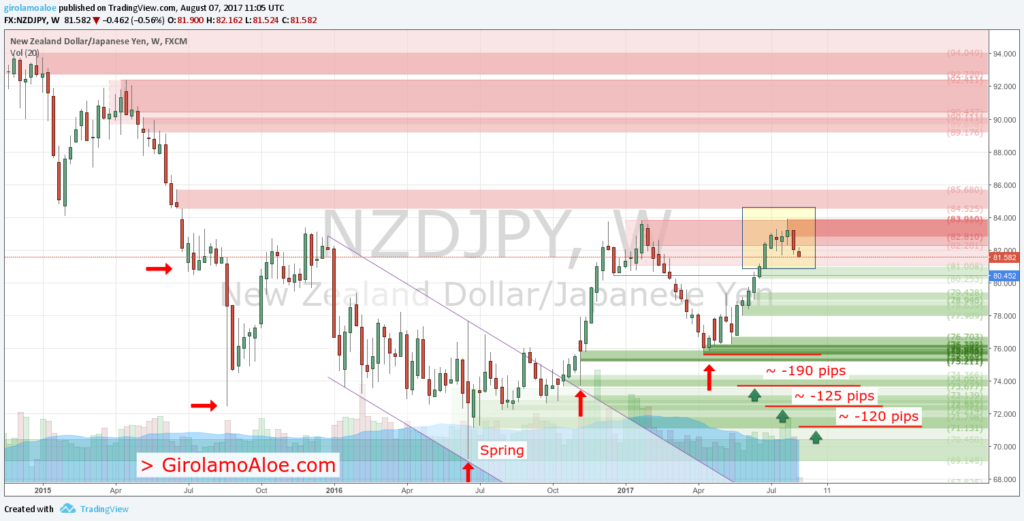

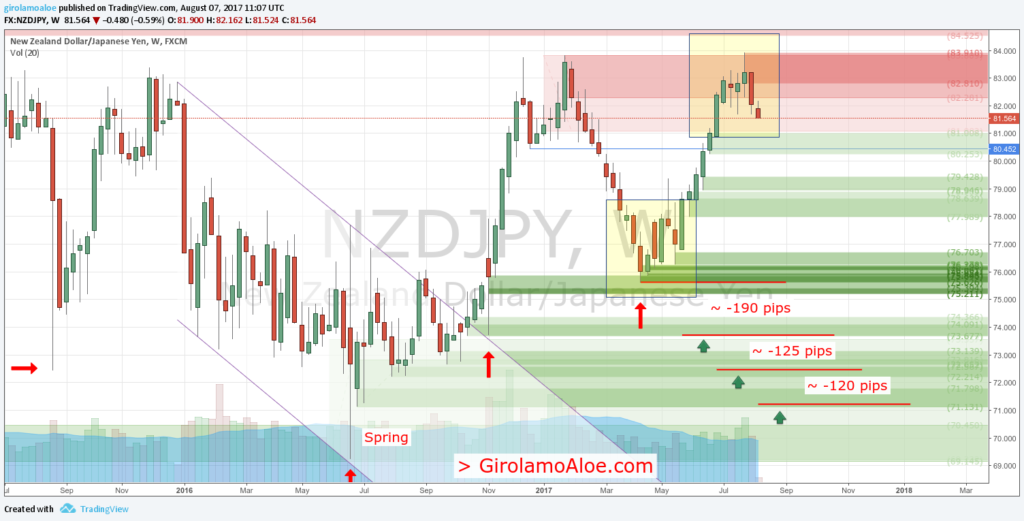

I want to show you a Trading Scenario around NZDJPY.

The weekly chart shows the Spring in the Wyckoff Trading Range.

The supply action tested again the possibility to continue the bearish trend. But it failed. So the new buy block trades moved the price again into the range.

The Composite Operator accumulated consistent resources to test the reversing of the trend. So, the price jumped across the creek and then it ran throughout the range, marking new points of demand.

But, you see that the spring occurred too soon. So the remained supply was still strong.

The resources of the Composite Operator were still not enough to take out the Supply Edge. So the remained Supply tested again to continue the bearish trend. But the price has found an opposition to one of the higher points of demand.

The opposition in the backup shows that the Composite Man increased its resources.

In the monthly chart, you see that the price could try to continue the bullish main trend, at least for a moment. But it has still chances to fail.

In the Demand Accumulation, there were opportunities to buy anticipating the markup. They occurred in the latest points of demand, going forward from the Spring.

Stop Loss in the NZDJPY Trading Scenario and Forex Millionaire Strategy

NZDJPY shows a throwback to ~76, offering a buying opportunity in the highest point of demand. But the price had chances to fall to the lower points of demand.

On the chart, I marked indicative distances between possible entries:

- High: ~190 pips.

- Lower: ~125 pips.

- Lowest: ~120 pips.

You understand that if you opened a trade at ~76 with a Stop loss of 60 pips, you started with a disadvantage. The highest entry around ~76, carried chances to fail.

As I told you, you cannot limit your “view” to only one trade. In the most of the cases, your entry point would be wrong.

This falls into the Trading Philosophy of the Forex Trading Success Stories I showed you.

The Bill Lipschutz and Stanley Druckenmiller Forex millionaire strategy describes a few things. Let me show these important concepts again. So that you can set them very well in your mind:

- Your success doesn’t depend on being right more often than you are wrong.

- You have to be right for the 20% or 30% of the times.

- That 20% or 30% of right trades should give you a consistent return.

- Choose a trading size that avoids the forcing out of your position when your timing is inexact.

- Preserve your Capital.

- Build long-term returns.

- Pursue the profits, in an aggressive way, when trades are going well.

- Maximize the opportunity when you are right.

- Minimize the damage when you are wrong.

- The Trading Plan is much more important than the Stop Loss.

In the NZDJPY Trading Scenario, you define your Trading Plan.

In the Wyckoff Trading Range, you skip trading before the Spring. After the Spring, you prepare your buying action in the Demand Accumulation. You do this, even if the markup could fail later.

If your highest trades get wrong entry points, the wrong Stop Loss of 60 pips gives you 3 things:

- It bites your balance account.

- It compromises your profitability.

- As consequence, the growing of your account becomes uncertain.

Forex Trading Success Stories: 69.48% of Realized Profit Buying ETHUSD

Stanley Druckenmiller’s long position on German Mark made me think of my buy trade on ETHUSD.

Stanley Druckenmiller gave a 60% of return to Quantum Fund. This is why he is in the list of the Forex Trading Success Stories.

I bought ETHUSD at a perfect entry. The purpose was to catch the automatic reaction in the bounce back.

I planned this first trade in advance according to the Trading Scenario in the daily chart.

This was my highest order in the initial buy action. I planned it for the beginning of the Wyckoff Trading Range.

The exit point was on the preliminary imbalance. So my trade reached the take profit giving me 69.48% of Realized Profit. This was a quick profit.

The Bounce Back in the Automatic Reaction is always Strong and Fast.

Later the price retraced back and I took a second planned trade.

It is relevant to consider that there was no leverage on this trade. So it was only the amount of money invested to give such large profit.

The 69.48% of return gave a consistent rising of my account balance. This shows also the increasing of my profitability.

I continue to improve. Then, I earn more money by trading, increasing my Profitability.

The impact of this buy trade is visible on my Profitability Chart. It shows the Growth of my Account for the latest 12 months.

Conclusion

Answering to my Profiting.Me student, I am answering to everybody who shows the same doubts.

You have clear now that the Stop Loss does not matter much. But the wrong Stop Loss that you set trade by trade, can stop your account growth.

More damages come If you skip measuring the cost per trade. The fees have an extreme importance. You should compensate them.

I showed you the TOP 3 Forex Trading Success Stories. Those traders who are in the Pantheon of Traders.

They are currency trading millionaires. Or better they are Forex billionaires.

Their Forex true stories show the Forex millionaire strategy that makes you different.

As Bill Lipschutz said:

“It is very difficult to be different from the rest of the crowd the majority of the time, which by definition is what you’re doing if you’re a successful trader.”

This explains why you should not stay in the same room with newbies to debate about trading.

No Facebook, Telegram, Skype Groups or others will let you improve. It is so if you are a lazy trader and if you lose time listening to newbies.

There are people who contact me telling:

“I am a trader. I am a supply demand trader too. But I continue to lose money.”

These traders are in the wrong place and debate about trading with wrong people. Besides they are lazy in the changing of their wrong habits.

So, let me ask you a few questions:

- Would you learn Forex Trading from George Soros, Stanley Druckenmiller and Bill Lipschutz?

- Or you prefer a boy in a Telegram group who wants to sell you his Trading Signals for $20?

- Or even you prefer to pay a millennial on Instagram who shares expensive golden watches and super cars?

kaled says

Thank you, Sir, for the teachings and for the book recommended.

Mikeb says

Great post! I’d love i can find others like this in the future!