Today was my First Black Day of the 2015. I definitely made a bad trading since the morning and with Emotional involvement. The Non-Farm Payrolls injected volatility in the market and this did not help me in the afternoon, making my trading more difficult and I triggered other bad trades that affected my total equity. In practice I closed only one trade in profit. Emotional Trading.

It is strongly necessary that the percentage of trades in profit become higher of the ones in losses.

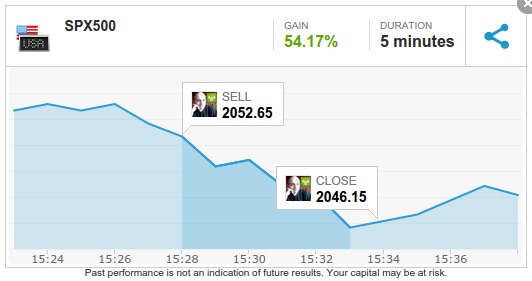

I have recovered almost all the losses of today with just one trade on $SPX500 entering in the break even, but definitely It is not acceptable that one trade has to recover the situation after many mistake.

The morning was bad, I had a good trade but I wanted to wait the end of the bounce hoping to see more profit in the new down front, but it squeezed my trade closing at zero. I tried again but I collected only three mistakes, squeezed each time.

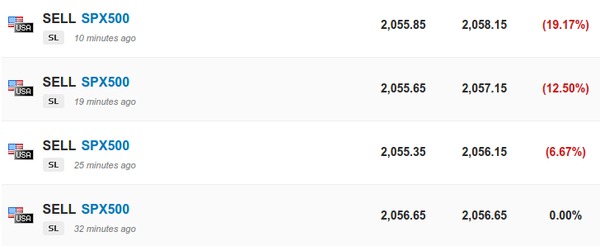

Here you can see what happened:

- I didn’t close the good trade when there was the reversal signal, waiting a new fall at the end of the bounce up.

- Conviction that the end of the bounce was there and a wrong evaluation of the Stop Loss on eToro, I did not consider properly the spread.

- Again the wrong Conviction of the ending of the bounce, another wrong evaluation of Stop Loss because the spread.

- Risking another trade in sell at a higher price that went in Stop Loss again.

The result is that it squeezed my trades each time, then I have lost money (fortunately recovered later for the most).

The lesson is:

Don’t enter in the market again and again if your plan has already failed.

I was in profit, but now I close the week in red for my manual trading. But I always hope to get the last trade of the week that can let me recover the small loss that I still have. Emotional Trading is always a problem.

Samuel says

Hi, nice blog!

I am newby and I’m only trade with SPX500 it’s me thing. And I have days like you of emotional trading (you can not describe with a better word) and other trades has to recover my failures. But I have one question for you. What kind of risk level do you use in your trading? And where and how do you set your stop loss?

Thanks!

Girolamo Aloe says

The first rule is always: Cut Losses Quickly.

My Risk is minimum. For me is better let that a wrong trade is blown away that have it there in deep red.

If I set a trade I try to have Risk Reward 1:2 … but if the trade is not more supported by the price action, I try to reduce the risk more, because it can fail.