Invest in Copy Trading is like invest in Funds. It is possible to Estimate the Return on Investment (ROI) in a way that everyone can do by himself, without the use of specific software – SIMPLE IS BETTER – setting 1 month as time frame, defining a Period and Evaluating the Average of the Performances for the Period. The result is the relative Growth Rate on Investment in that specific time frame.

The Growth Rate represents the Estimated Copy Trading ROI.

But it is an Estimation. Then it needs a refining time by time.

Copy Trading ROI as a Benchmark

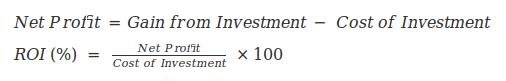

The Return on Investment is a relation between Net profit and Capital Invested:

Instead what is necessary is an Estimation of the ROI.

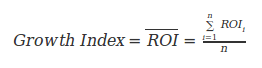

A way to Estimate the ROI and use it as Benchmark to Evaluate the Future Net Profits is:

- Set 1 month as Time Frame.

- Set 6 months as Period.

- Calculate the Average of the last Performances (Real ROI) in the Period.

The Growth Index is the Benchmark to Evaluate the Monthly Profit.

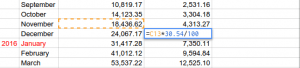

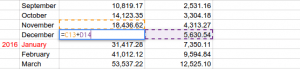

As every benchmark, it needs a refining time by time, getting the new Ending Month Total Equity and adding the new Performance Data in the Period.

Accuracy of the Copy Trading ROI

The Choice of the Period has a strong impact in the accuracy of the Copy Trading ROI.

The length of the period depends of what you are looking for your investment.

When you add a trader in the portfolio, you have already analyzed the trader, considering his performances in the middle long-term. This means that the trader to copy has already a relevant history of his Performances. This gives an sign of reliability of the trader. Although past performances are not indicative of future success.

1 month, 3 months, 6 months, 9 months, 1 years or others are potential periods usable. Which one use is a choice and it depends also on the data that you collect, especially if they are highly scattered.

The best situation is when a trader has, time by time, a Performance Data that is in line with the earlier ones.

Excessive normalization of the Copy Trading ROI

Longer is the Period, less useful could be the Estimation of the Copy Trading ROI.

This happens because if the performance data collected in the long period are highly scattered, this makes loose details. Some relevant information to refine properly the Copy Trading ROI could be “adsorbed” in the Estimation.

This doesn’t happen for every potential investment in Copy Trading. It depends on the trader that you want to add in your portfolio.

Net Profit Evaluation

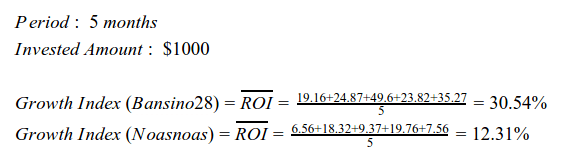

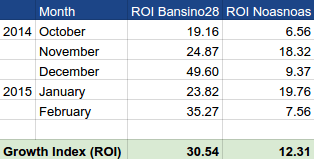

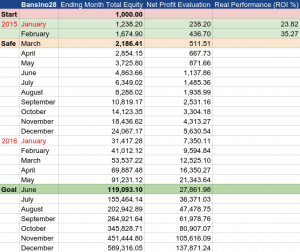

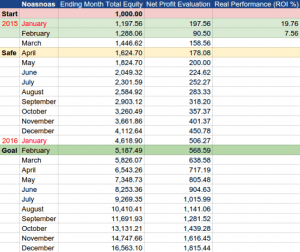

Case Study: Bansion28 and Noasnoas

The Copy Trading ROI for the Period makes possible Evaluate the Monthly Net Profit.

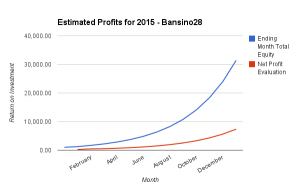

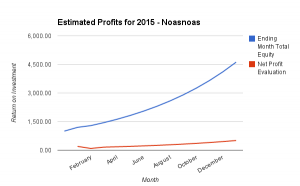

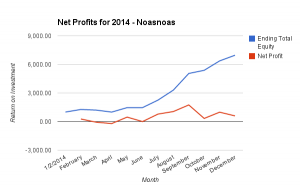

These Charts show the Estimated Profits for 2015 of Bansino28 and Noasnoas

Copy Trading gives a Parabolic Growth to the Account.

It is visible in the Bansino28 chart. Instead it is less visible for Noasnoas because in this case the growth is slower.

But Noasnoas chart shows the refining for Jan and Feb 2015. This makes clear the importance to Refine the Benchmark time by time to increase the accuracy and make the Growth Plan more realistic.

The Evaluations of Net Profits for Bansino28 and Noasnoas show different trading approaches.

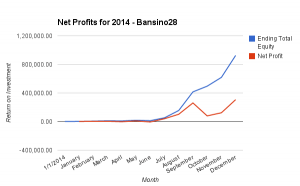

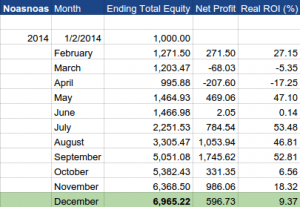

Real Net Profits for 2014 Copying Bansino28 and Noasnoas

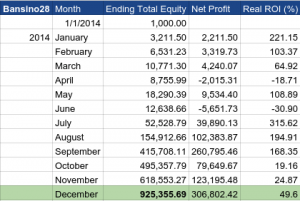

Using the Real ROI (%) of the 12 months of 2014 for Bansino28 and Noasnoas, here is possible to see what potentially was the Return on Investment, month by month, with $1000 of Capital Invested in the Copy.

These details based on Real Data of Performance (reported on the relative Openbook profiles) let understand the real importance to have a Growth Plan and a Specific Margin Risk for the Investments.

Conclusion

The Evaluations of the Net Profits and the Ending Total Equities are an indication, not a certain for the Return on Investment.

The Estimated Copy Trading ROI gives an ideal vision of the Future Return on Investment and help to make a Growth Plan for every investment.

It is always necessary set a proper Risk Margin for the Capital Invested, specific for every Copy Trading Investment.

The Growth Plan lets understand when the Capital Invested will be Safe, out of the risk to lose it totally or partly in the case of a negative bending.

Note: to Evaluate the Return on Investment with more accuracy is possible to use also the Polynomial Interpolation and other common Growth Functions, but it is not an easy way to apply manually. It requires a lot of manual work or a specific software.

Michael O'Sullivan says

Doesn’t this assume that the full $1000 will be copied and therefore included in that growth? If for example you copy with $1000, Bansio will only ever have around 30% of this invested at any time, which is where the growth will occur. 30% growth on 30/40 of account balance.

Does that make sense?

Girolamo Aloe says

Hi. It is not correct. Copy Trading is like invest in fund. It doesn’t mean “what make bansino for his trades”. Knowing how bansino manage his trades, can be useful probably to set properly a Margin Risk, but it is not good for the ROI of the Copy.

Your investment is $1000 (in this example) and it is all allocated to the Copy. Not a small part of $1000, but the Whole $1000 are allocated. It is your Capital Invested. You can not touch the money allocated that are not used in trades opened, without compromise the Equity in the Copy and then the Size of the trades that will be copied in future.

Then the Return On Investment is based on the Capital of $1000 that you invested. Your growth rate follows just the Total Equity allocated in the copy.

In this post the Growth Rate for the copy is calculated in the EASIEST WAY, then you need to adjust it every month. But Growth Plan for the Copy gives you an ideal vision about where you are going with your investment and help you to make your own decisions about it. And also it says when your investment in the copy of a trader will be safe: out of the risk to lose it.

In any case, the Monthly Total Equity Performances of a Trader are reported in his stats.