In this stage where I am still learning how to get the best by the manual trading practice, the Copy Trading is the best way that I have to make my Account Grow. It is not really important if I earn millions of dollars with my manual trading or copy trading.

The purpose is Make the Account Grow Consistently.

Copy Trading gives me the opportunity to reach every intermediate target in my Account Growth Plan. Each one of them brings me one step closer to my Final Goal.

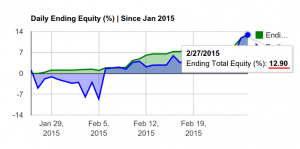

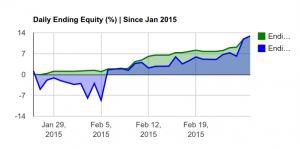

In February 2015 I have reached my First Target going over the +10% of the Equity. My Portfolio closed February without trades opened, touching the Return of the Investment of +12.90% in this 2015. Almost +13% since Jan 26. It is a good result for one month plus a couple of days.

Copy Trading Portfolio

My Copy Trading Portfolio has only one investment and I think that I will have only it for the long-term. I invested the 40% of my Account Balance on Bansino28. I copied him in my work account GiroeToro (no more active). I had invested a very small amount of money, so small that not every trade got the opening in the copy due to the limitations of the system. After many months the return of the investment has grown around +150% slowly.

When I moved to my old account jscmal the most logic thing to do was just invest a substantial amount of money on Bansino28.

Copy Trading is like invest in funds.

The main interest is in the performances of the trader where you want to invest and how he is able to stay profitable consistently in the long-term.

The Copy Trading is a Risk like any other Investment Practice. This means that copy people without a reasonable evaluation of their performances and without consider the risk for each copy is the worst way to invest. Evaluate every trader, that is a potential new adding in the portfolio, is fundamental and it is not easy.

Trading and Investing are not a gambling practice. They need a method, a lot of work, long time and experience to give a return of the investment consistently for the long-term.

Manual Trading. My Last Trade of February 2015

My mistakes by manual trading costs me money, but they let me learn from mistakes. I am a momentum trader. At the moment I don’t let trades run for days or months and I am particularly happy to cut losses quickly. I am applying in Forex every useful thing I have learned by stocks trading and I follow the price action looking for volatility, patterns and good breaking levels.

My last EURUSD Sell trade was definitely the best trade to close February 2015. It was perfect.

The patience to wait the right moment brings money to the pocket.

A mentor of mine says:

“Let the trade comes to you” ~ Tim Grittani

This EURUSD Sell was just the result of:

- Wait the volatility (the market was slow, but last USD catalysts gave an immediate volatility fluctuation in the chart).

- Follow the Float Rotation.

- Trade the Parabolic Pattern.

- Enter in the breaking of the Parabolic Pattern.

- Take the Profit in the dip.

Mistakes and things not good:

- The volatility has eaten 3-5 pips to the entry point after the trigger of the trade, I entered at the end of the bounce up.

- I was not ready when I closed the trade, then I closed too soon. But fortunately the volatility gave me more pips of profit (maybe 3 or more).

Leave a Reply