For many people, the idea to Copy a Professional Trader seems like a way to make money without effort. But Copy Trading is itself and investment. Then it carries high risk so as it is not something to do without the necessary analysis and precautions.

As a First thing, I have to say that I worked some years for an Israeli Social Trading Network. What I am going to say is something that I know very well, because I was part of the business. I gave my contribution for the growing of the Best Social Trading Platform. In the same way, I have experienced the behavior of who copies other traders thinking to become rich.

Since 2005 (but even before), Social Trading has grown year by year. The boom of the Social Investing has arrived with the Western Crisis, in the years after 2007. The western crisis affected many families in the USA and Europe. So, many people went to invest money using Copy Trading Platforms. All together made grow this business making the Social Trading very Popular.

What is Social Trading?

A Social Trading Network lets you invest on the work of other traders copying their trades.

This means that you can have in your portfolio trades that another trader opens. This happens with proportional sizes and without the need to manage by yourself the trades copied.

Copy Trading Services give to people a way to invest a small amount of money. In this way, everybody is able to invest in the Financial Markets even without know how to make trading.

Social Trading is very popular among those which invest on Forex and even on common Listed Stocks. The most of the brokers that let you follow forex traders, offer to trade by CFD (Contract for Difference). Trading CFDs everybody can trade investing a small amount of money. So, this shows that the Social Trading Marketplace is very large. This is possible because it can involve the biggest slice of the retail traders. Even who doesn’t copy other traders could be part of this business.

With the growing of the business, the Binary Options Platforms are providing also Copy Trading Tools. So now the Social Trading Marketplace includes also the Binary Options Social Trading.

What to look before to Copy a Professional Trader

Copy Trading is a practice that demands particular accuracy. The reason is that it is very easy to copy a trader that at a certain point loses everything.

So, if the trader copied loses all the money, you will lose the money invested.

When you think to invest money to Copy Forex Traders there are some common questions to ask yourself:

- Can I afford to lose the money that I am going to invest copying this trader?

- Am I going to Copy a Professional Trader or he is a trader that is experiencing a spike up?

- Does Copy a Professional Trader guarantee that I am not going to lose money?

- How can I recognize if a trader to copy is profitable for the long-term?

- So, what should I look before to Copy a Professional Trader?

Before to Copy a Forex Trader you must look to his profitability, always and in any way.

But he has to show a long-term profitability and not only for a few months.

If a trader is earning for only a few of months, he has not done enough. Then his performance is not enough to accept the risk to invest on him.

To risk my money to copy a trader (named by someone “popular investor”), I want to see results. This means that he must show a constant growth for the long-term.

This is the most important thing. More than any other.

Important Warnings to don’t Copy a Professional Trader

Forex Copy Trading carries high risk like any other Investment Practice. So many newbies approach to a Social Trading Network without understanding the risk.

Even if I worked years for a Social Investment Network I don’t recommend Copy Trading anymore.

People are so blind as lazy. They to don’t make the effort to understand where they are going to invest.

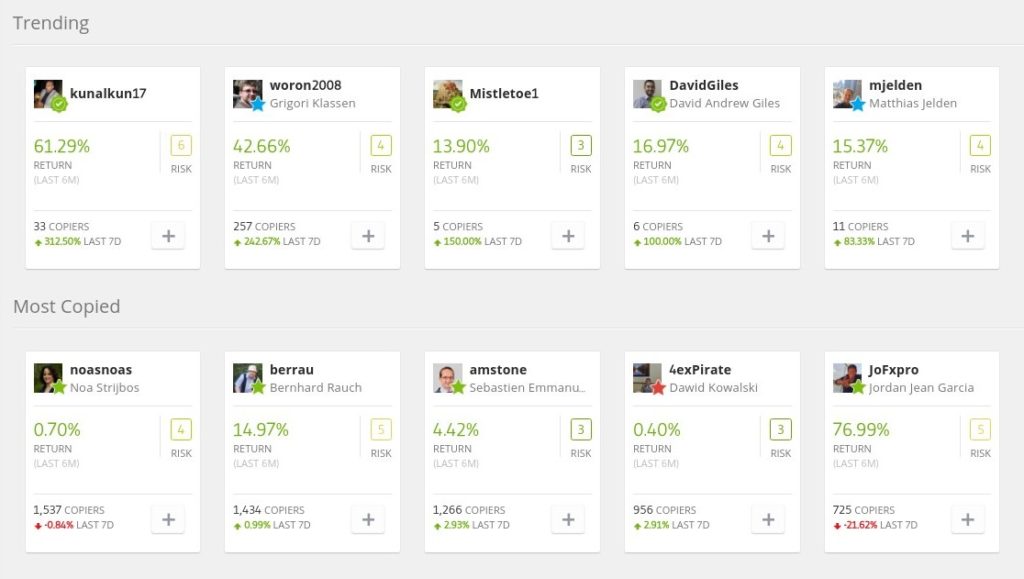

This means that they don’t look to the best forex traders to follow. But they look to what others are doing.

For example, It is like the mass of people who watch the news on TV. They don’t take the effort to think about the news. They only follow a news and let that it influences themselves without thinking about it.

I don’t recommend Copy Trading to my students on Profiting.Me. I even don’t let people copy my trades so as I don’t give and I don’t sell Trading Signals.

If you consider that Forex Trading Signals are pure Trash. What should you think about the practice to Copy Professional Traders?

You must keep in mind that Copy a Professional Successful Trader is a rare thing.

You should also consider the behavior of who is copying another trader. Indeed, a newbie who invested to another trader, could not manage in the right way his emotions. Then, he could not be able to manage his investment in a proper way.

So, let me give you a small set of warnings:

1 – Don’t follow the Crowd, it is not wise

The first and the most important things to take in consideration is that the crowd is not wise.

The “wisdom of the crowd” doesn’t guarantee success in copy trading.

Indeed, in the most of the cases, it induces a trader to take wrong decisions and then, bad investments.

Don’t you think it is not true? I am sorry, but It is true and it is a real problem.

The wisdom of the crowd influences anybody to act in a specific way. So, if the focus is a trader with extreme performances, this will induce other people to copy his trades.

The mistake is that the most of them will not take care of what the trader to copy is doing.

Every trader can act earning impressive profits. But only a few traders are profitable for the long-term in a constant and consistent way.

During my years working for a Social Investing Network, I have seen this many times.

Knowing this, it was clear to me what soon or later was going to happen. All these traders are “bait and switch”. Instead, newbies think that they are going to Copy a Professional Trader.

Then in a systematic way all them, one by one, lose almost all the money. So those attracted by them lose money rising frustration and angry.

This carries a massive negative reaction counter the broker. This is the main reason around all the negative reviews that Social Trading Platforms receive.

So, don’t copy a trader only because it is popular. But look at what he does and to what are his performances for the long-term.

2 – Don’t Trust of Professional Traders so as Don’t Trust of Amateur Traders

Many times you see traders that introduce themselves saying something like:

- I am a certified trader.

- I trade for this fund or private bank.

These are all interesting things. But they change nothing.

The only important thing is the real Profitability of the Trader.

When I was younger, I was a worker for Intesa SanPaolo Bank. Talking with Traders, they told that they make “disasters” too.

Sometimes even a Trader in a bank can lose hundreds of thousands of Dollars.

Working for a Social Trading Network I have seen Professional Traders burn money in a bad way.

What was curious to see with these traders?

They used to contact their Account Manager to “legitimate” their losses. The result was that copiers have lost money. Even the account manager has lost a part of his investment copying the trader.

What I want to make clear to everybody is a simple thing:

No Career Profile can guarantee that Copy a Professional Trader makes you rich.

In the same way, No Career Profile is a confirmation that a man is a Professional Trader.

Indeed a Professional Trader so an Amateur Expert Trader can earn and lose money in the same way.

Who works for a Bank or Fund could not trade like a retail trader in an official way.

It depends on the agreement he has with the Financial Institution.

So, Don’t Trust anybody, professional or amateur traders.

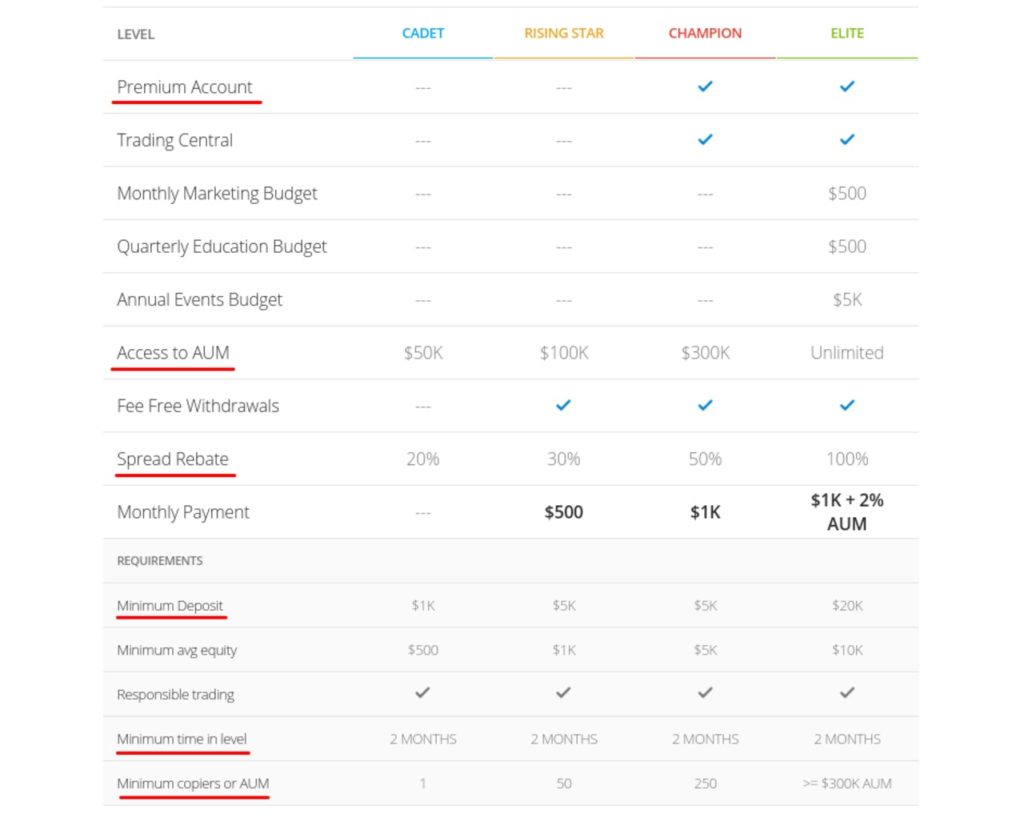

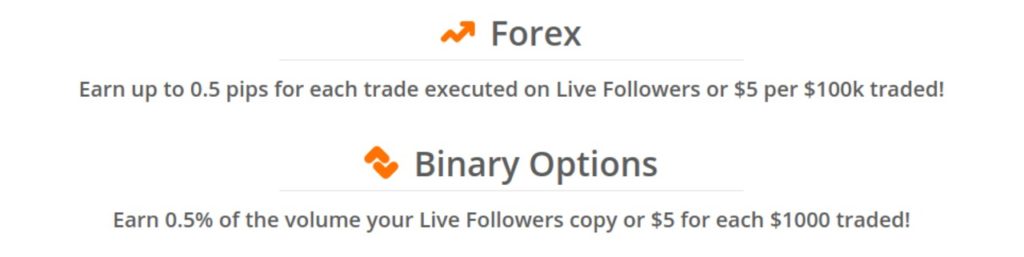

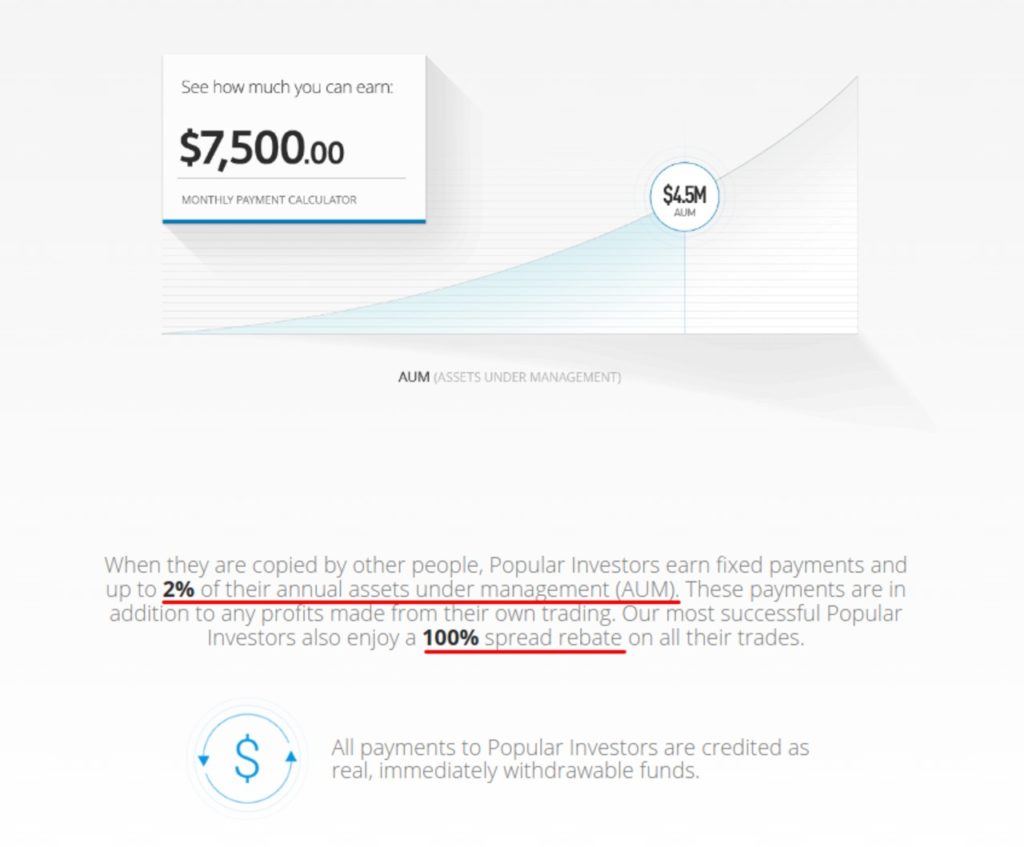

Never forget that the most of these Popular Investors want only new people who copy them.

The reason is that they earn Spread Rebates and many more rewards.

3 – Don’t listen to the Broker Suggestions

Be aware that any Broker in any marketplace, is not your friend.

An account manager can contact you if your account is reaching a specific amount of money. For broker that offer to trade CFDs, it could be like $20K-$25K. He will ask you to deposit money to reach that threshold to become “premium”. In this way, you will get higher privileges and more benefits.

But, the bonuses that the broker offers you to copy a trader or to deposit money, are not free. You must redeem them according to the terms and conditions.

You can accept bonuses no more that one time and only if they are a few dollars. The reason is that you could not be able to redeem those bonuses in the short-term. In the same way, your losses could be so high to don’t let you cover the bonus losses. Then you will have to deposit again.

He could also invite you to get more copies, offering you other benefits. For the same purpose, he could also invite you to become an affiliate.

Besides, the Broker must follow the Trading Regulations. So it cannot tell you what to do to earn money. Then it cannot tell you which are the Best Forex Traders to follow.

It can show you the most popular traders of the moment, taking them from the Copy Trading Ranking. Then, it shows you what the crowd is copying for now.

So you understand that you cannot Trust of what the broker suggests to copy time by time. It will “pump” who the crowd is already copying.

Then it will not care of who shows a better quality of trading.

4 – AUM and Self-promotion to get more copies

People who want to Copy a Professional Trader have to engage money for an investment.

The copy of the trader assigns the money invested in the Assets of the copy.

This means that the trader in the copy is managing more money of what he has in his account.

Then the Copy Trading Platform builds a “Pyramid” of investors which copy a trader.

The Pyramid shows the origin of the total amount of money used to copy a trader.

The Assets that a trader manages come from the money that other traders engage in copying him.

This can happen by different levels making the Pyramid.

You copy a trader and another trader copies you. The Asset Under Management (AUM) doesn’t come only from your money engaged to copy the trader. Indeed, it includes the money engaged by who is copying from you those trades that you are copying.

Assets Under Management (AUM) is the amount of money that a trader manages, allocated through the copy of his trades.

The Social Trading Platform can assign a reward to a Trader based on the AUM.

So, the trader has to promote himself in the best way to get more copies. In this way, he increases the AUM earning a higher reward time by time.

Indeed, many popular traders are in reality self-promoters that traders of quality.

You can see this watching how they manage the trades in their portfolio.

So, I repeat again:

Don’t Trust anybody. These popular investors want only to get more copies.

5 – Stay away from who doesn’t show a stable Profitability

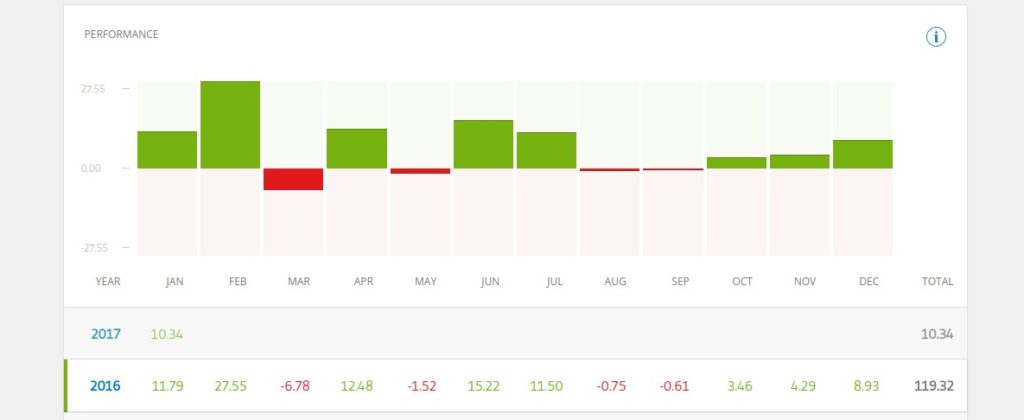

As I told since the beginning, the most important thing is the Profitability. So if I want to Copy a Professional Trader I must take a look at his Trading Performances.

If a trader shows a constant growth in his account, he could be a valid candidate for a copy.

Of course, he has to show profits month by month or even year per year. More the growth is constant better it is, in general

If a trader earns between 10%-20% per month it is not bad of course. But this should happen every month.

Instead, if the trades shows too many discrepancies month by month, this is not so good. Indeed, his profitability is not stable or he had problems to manage his trades, in general.

Another thing to take in consideration is the Return on Investment (ROI).

Watching the profitability, I look also for what kind of rewards the trader gets from his trades.

So if the rewards are very high, this is not so good. This is even worst if he shows these high rewards having an uncertain profitability.

What I am saying is that:

Who has rewards of hundreds or thousands in percentage are not to copy. They are investing a large part of their account with very high leverage.

In the same way, they could be traders with a very small account so they invest everything.

They get a very high ROI carrying an extreme risk to lose everything.

For what I have seen working years in the Social Trading Company, soon or later they will burn the account.

So, if you want to Copy a Professional Trader, find a Responsible Trader with a Constant Account Growth.

Conclusion

Now you know these 5 Warnings about Copy Trading. you also know that I don’t recommend copy trading anymore.

These warnings show you the risk that you take going to copy a professional trader so as an amateur trader.

Copy Forex Traders is a very common practice. It is important that you understand the risk around this practice. A real advantage comes from restrictions that the broker can apply in his services.

This means that the Copy Trading Ranking could show only profitable traders. Besides, even the plans to offer to become popular investors can have restrictions. In this way, only traders with a real and constant profitability can become eligible for the copy.

So, companies that base the core business on Copy Trading can show valid trader to copy. This is possible because they set restrictive rules.

In any other case, it is better to don’t copy anybody and trade by yourself.

Be aware that make trading by yourself is always the best thing to do. Invest in your education and study to become a better trader.

This is the right way to earn money. Indeed, this is what I do: I invest by myself and I improve my trading day by day.

In the same way, this is how the Profiting.Me students improve day by day, studying with dedication.

So, let me ask you some things:

- Which was your worst experience by Social Trading?

- Did you copy a professional trader who gave you in return a large profit?

Leave a Reply