Did you ever think that a way to earn a good reward is by Trading False Breakouts?

I have to say that it pays very well. But it happens only if there are specific circumstances.

The mind accepts the idea to trade the breakout so as the breakdown. So, the focus is always on the breaking of something to see a new spike up or down.

Trading breakouts so as trading breakdowns is a high-risk practice.

Indeed, any tentative to Buy on the Breakout is an action to Buy High.

It is the same thing also for the breakdown. When you sell on breakdown you are selling when the price is very low. Then, trading breakouts so as trading breakdowns carries a very high risk.

Before to take any action, an expert trader makes a proper risk evaluation. On Profiting.Me I make clear the importance to understand the risk degree around any possible entry point.

First of all, I don’t trade breakouts so as I don’t trade breakdowns. The reason is that I have no interest to take such high risk in the most of the cases.

Even when there is a rotation my interest is to Buy Low at the beginning of the new trend.

I always look to Sell High or Buy Low at the beginning of a new trend.

This means that I look for the new and fresh imbalances. But not every imbalance.

I need those imbalances that push the price in a direction at the end of the trend rotation.

The Breakout Trap

What happens when you buy high or when you sell low?

Let me ask you this in a different way.

What did you experience many times when you sold on breakdown so as you bought on the breakout?

Without a specific reason, like a Catalyst, in the most of the cases, you and I have had losses. This is the result of Trading False Breakouts so as False Breakdowns, buying high and selling low.

The breakout, in trend or in a range, happens with some specific circumstances.

First of all, the price converges on a range where there are high chances to get an opposition. So, orders in opposition can contrast the momentum that is pushing the price in a direction.

To get advantages from a breakout the price must converge on a Supply Level that is Weak.

So, the Price Consolidation in a Trend Rotation to Bullish can offer a breakout opportunity.

There is a Persistent Supply Level that gives an opposition to the Trend Rotation. It becomes weaker every time it pushes down the price.

On Supply Levels that are Not Weak, Trading False Breakouts works better.

Then, you see the Breakout Trap and it depends on the strength of the Supply Level.

If the Supply Level is still strong the price can rise over it to drop later, going down deeper. Most of the times this happens when the price is high in the Trading Scenario. Then, at the end of a Bullish Momentum.

This means that the imbalance for that Supply has changed marking a new Reversal Point.

What is a Breakout Confirmation

The most common question is “how to avoid false breakouts?”. Of course, the answer is “wait for a breakout confirmation”.

There are different ways to get a Breakout Confirmation in a Trend Rotation so as in a Trend Continuation. Some of them are easier than others to recognize and to use for trading.

The most common Breakout Confirmation is part of every Breakout Trading Strategy. Indeed, any simple Breakout Trading System is a Pin Bar Strategy.

So, when you wait for a Breakout Confirmation you look for an Inside Bar so as for a Pin Bar.

Of course, more than any Inside Bar Trading Technique, I would like to trade a clear Pin Bar.

In a Trend Rotation, a Pin Bar is the easiest Breakout Confirmation that you can expect.

So, an easy and clear Breakout Confirmation needs a favorable Trading Scenario. Let me describe this with a few words, showing you a very easy example of the Breakout Confirmation.

Breakout Confirmation in a Trend Rotation

In a Trend Rotation, the price consolidation shows helpful peculiarities.

When the price is ready for a Breakout, it moves over the Persistent Supply Level.

So, the sellers can push down the price. This can happen by a Catalyst.

A Catalyst gives the illusion to experience a False Breakout, moving down the price in a quick way.

What the Catalyst does is only to push the price where Big Buy Orders are waiting for the execution.

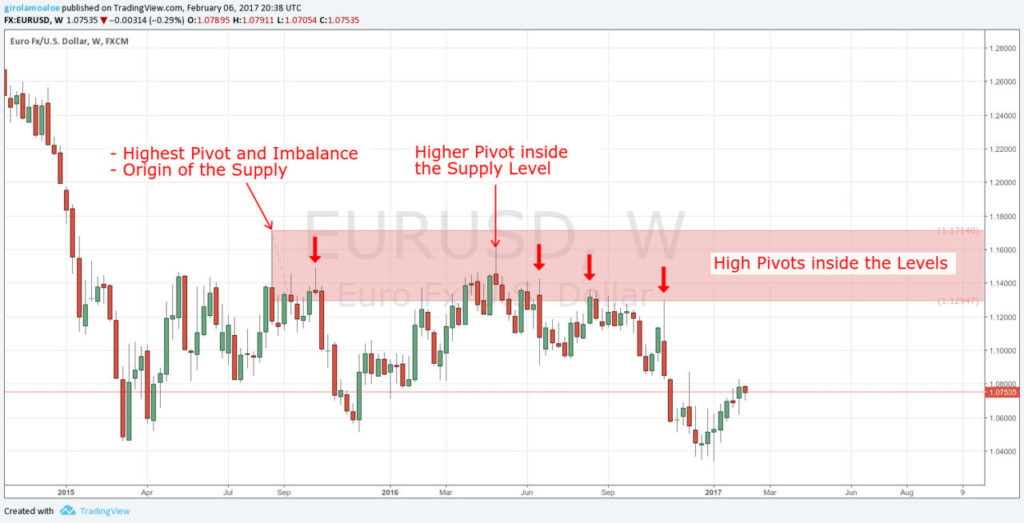

The Price Action in the consolidation shows a behavior for the Trend Rotation. So, there are the Breaking of the Bearish Trend and Low Pivots for a Bullish Rotation. In the same way, there are a Persistent Supply Level and new and fresh Demands that will favor the Breakout. Besides, there are High Pivots inside the Persistent Supply Level that makes the level weak.

The Breaking of a bearish trend so as the taking out of a Supply Level marks a new Demand.

When the price converges to the new and fresh Demand the buyers push it up with a strong momentum.

This is a Demand Level with high chances to get a Reversal Point. It is where I would set my Buy Order for my low-risk Buy Trade.

This is the easiest Breakout Confirmation for a Trend Rotation. Of course, this is different that Trading False Breakouts.

Trading the Trend Rotation with a Breakout Confirmation

In a Trend Rotation to Bullish, you have a Persistent Supply Level. The price tests the Supply Level, time by time until the imbalance will push the price over it. The real taking out of the Supply Level completes the Rotation to Bullish.

The Breakout Confirmation offers 3 Trading Opportunities with different Risk Degrees.

- Buy low when the price converges with the new and fresh Demand Level. This is the best trading opportunity with the lowest risk in the Trading Scenario.

- If it will be possible Buy in the retracing back. The price action would cover the first half of the long tail of the pin bar. It will converge to another new and fresh demand. This is a trading opportunity with a risk that often could be acceptable.

- Buy on the Breakout because the strong momentum would take out the new Supply Level. This is the riskier trading opportunity that always I avoid because it is buying high.

At least 2 of these 3 trading opportunities happen in the most of the cases. Where to buy depends on the risk but also from how the price leaves the demands level.

Don’t forget that I am talking only of the easiest Trading Scenario for a Breakout Trading Strategy.

In a Trend Rotation to Bullish, all these things are part of a Rotation Framework. What has a real relevant is always the last step of a Rotation Framework to Bullish.

The new Bullish Trend doesn’t begin with the Breakout.

But, it begins with the strong imbalance, where the price converges with the new and fresh Demand.

This is one of the reasons why I always look to Buy Low.

High Pivots and Low Pivots on Supply and Demand Trading

Any reversal point is a Pivot but not all the pivots are relevant for trading.

Trading False Breakouts is to recognize Reversal Points over Supply Levels. In the same way, Trading False Breakdowns is to recognize Reversal Points under Demand Levels.

What you need to know is that High Pivots and Low Pivots mark new imbalances.

You need to distinguish between these different Pivots:

- Pivots inside a Supply or Demand Level.

- Pivots over a Supply Level so as under a Demand Level.

There is a real difference between them. This difference is in the way they affect your trading experience.

1 – Pivots inside a Supply or Demand Level

When Pivots are inside a Supply or Demand Level they are new imbalances that make the level weaker.

For this reason, they are able to refine and change the risk degree for a Supply or Demand Level. They are Reversal Points that show where and how the opposite orders, inside a level, push the price back.

In the same way, they are important because they show how and where a Supply or Demand Level becomes weaker.

Understand the importance of Pivots in the Price Action, is fundamental to make Trading in a proper way.

The weakening of the Supply or Demand Level comes with any new Pivot inside the Level.

This makes the price go deeper inside the Level. Then, they suggest where to look (and not) for an entry point inside a used level.

2 – Pivots over a Supply Level or under a Demand Level

When Pivots are over the Distal Line of Supply or Demand Levels they can mark a False Breakout.

This happens when the price rises over a Supply or drops under a Demand. Besides, in this circumstance, the momentum is not enough to overwhelm the orders in opposition. So, the price retraces back going deeper in the opposite direction.

This shows an easy way to recognize a False Breakout. Of course, it could also need a confirmation sometimes.

Trading False Breakouts you have to recognize High Pivots over a Supply Level.

In the same way, Trading False Breakdowns you need to look for a Low Pivots under a Demand. This is the first thing to do.

So, you have to look for where the price is retracing back after a new High Pivot or Low Pivot.

If a breakout fails, it happens by a changing in the Supply imbalance.

So the High Pivot marks a new imbalance from where the sellers are pushing the price down.

Now you have an answer to the common question “How to identifying false breakouts?”

Trading False Breakouts

Now you have clear what are the Pivots and what is their role in the Market. Then, now you can realize what kind of advantages you get from them.

Keeping the focus on High Pivots that go beyond the Distal Lines, you can recognize False Breakouts.

Trading False Breakouts is as risky as it is the Trading Breakouts.

Even if people would mention a false breakout pattern, it is not possible to set an order in advance. At least, not in all cases.

Indeed, in the most of the cases, Trading False Breakouts is how you react after the Reversal Point. But this is not the only way. The reason is that the Price Action can offer different opportunities.

First of all, trading misleading breakouts is not chase a trade, going to run behind the price falling.

Never Chase a Trade and Never Force a Trade, in any Circumstance.

Instead, what you can do is to consider the Supply Level around the new High Pivot. So, you look for the new imbalance that the High Pivot marked. Besides, you look also for the old supply that the price left back when it marked the new High Pivot.

For any false breakout strategy, there are some things to take in consideration. I am not here to describe Trading False Breakouts Strategies. What I want to do is to show the easiest ways to get opportunities Trading False Breakouts.

So, I want to limit the discussion to only 2 cases that are the easiest ones in my Trading Style.

- Retracing Back after a Pin Bar with Long Tail.

- Price Progression under the Supply level and Flipping back.

1 – False Breakout with Pin Bar and Retracing Back

When the price converges with a Strong Level, it shows one of the easiest ways to make trading.

Without spending too many words I can say that a Pin Bar in a Parabolic Rotation is a Great Advantage. This is profitable with or without a Pivot for a False Breakout or for a False Breakdown.

A Pin Bar shows a strong imbalance that pushes the price in the opposite direction.

Trading False Breakouts the Pin Bar from a High Pivot shows trading opportunities.

The strong imbalance pushes the price down marking a long tail.

So later, the price tends to retrace back trying to cover the first half of the long tail.

The Retracing Back is not casual and it is not illogical. It happens because the bearish momentum becomes weaker. So, the demand willing prevails pushing the price back again.

The Strong Supply Imbalance takes out the highest Demand Levels marking new Supplies.

You can see this going to the lower time frame. So, the Retracing Back will find an opposition on a new and fresh Supply Level.

The strong Supply Imbalance should take out at least the highest demand.

In the retracing back, the new Sell Orders in the new Supply Level will continue to push down the price.

Trading False Breakouts you can Sell High on new Supply Levels where the price goes to retraces back.

2 – False Breakout and Price Progression under the new Supply

What to do if the price will not retrace back enough or if there is no Pin Bar?

The price will drop going under the new Supply Level marked by the High Pivot. This means that with or without a strong imbalance from the Pivot, there is a bearish momentum.

Even in this case, you look for a retracing back.

Some of you could say: “if the price is going down, I sell”.

This is a mistake because you have always to look for low-risk trades. In this case, you are thinking to chase a trade. So you are looking for a high-risk trade. Never Chase a Trade. This kind of risk is not acceptable.

Instead, you need to prepare your trade according to the Price Action.

Even if there is no relevant retracing back, the price action is always marking new supplies.

The supply levels are pushing down the price taking out the correspondent demand levels.

Then, you can see on chart reference point that you can use for selling.

Of course, not all the new Supply levels are good for trading. But you can look for the new and fresh Supplies that broke a trend so as took out strong demands.

In these circumstances, Trading False Breakouts is like the following of the Bearish Price Progression.

Conclusion

There are consistent advantages when you keep your focus on Trading False Breakouts. But as you have read, it is not so immediate for newbies, because their focus is on Breakouts.

But there is one more thing about Trading False Breakout that is more a trading trick or a trading tip.

If you didn’t Sell in the Convergence with a Strong Supply, you have chances to sell its False Breakout.

Then, you wait to trade later, when the price retraces back converging to a new Supply Level.

This kind of Forex False Breakout Strategy is not so bad as it can seem. It is all about mindset because what you need is to keep your focus on the False Breakout.

I don’t trade breakouts in the most of the cases because it is a practice that carries a high risk. For the same reason, I don’t trade the Breakdowns.

I know very well that when the price converges with a Strong Supply, it can mark a new High Pivot.

So, If I had no orders, it gives to me other chances to set a Sell order.

I can succeed Trading False Breakouts because I know how the Price Action works.

So, I get more success in this way that Trading Breakouts.

Indeed, getting success in this way, also those Profiting.Me students who study with dedication will be successful.

Price Action is everything. If you understand it in the right way, never more you will suffer because of money.

Everything I explained about Trading False Breakouts is valid for Trading False Breakdowns.

So, let me ask you some things:

- Did you ever Chase a trade on a false breakout?

- Do you Buy High hoping for a breakout?

- Do you trade breakouts by Catalysts on Forex or Stocks?

Leave a Reply