if you have learned and if you follow a Good Mentor, understand the Price Action Patterns is very easy. In the same way, define the Risk Reward is easy if you have in mind a specific plan that respect the pattern.

Instead, the most difficult thing, and this depends only from you, is just be able to trigger the trade in the right moment and in many cases also the simple action to trigger is really difficult, losing good opportunities.

Experience and Attitude are the difference in trading.

My best trades of today are just a couple on $SPX500 and $USDJPY, nailed at the best entries, putting in the pocket the profit.

https://twitter.com/jscmal/status/553222225630068737

I stay focused on $SPX500 and for this index the difficult that I have are:

- the volatility

- 100 pips of spread

The spread is really high in eToro then is necessary Cut the Losses Quickly and stay focused to catch the best opportunities, planing at least 200 pips per trade as Reward.

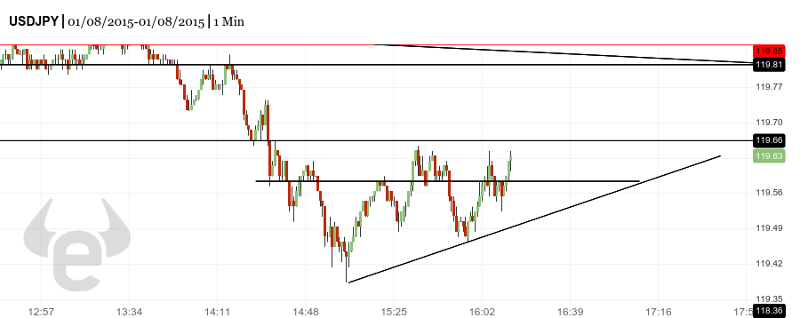

I keep my focus also on $USDJPY because also if the chart is really choppy, then dangerous, it has only 2 pips of spread.

https://twitter.com/jscmal/status/553203912690647040

And I add also another $SPX500 trade closed in the last night following a predictable pattern that gave me a lovely profit.

https://twitter.com/jscmal/status/553026786851045376

When the percentage of trades closed in profit (or zero) will be higher of the ones closed in red, I will be ready for more.

I am studying to improve my trading and I hope to come back to trade Stocks very soon.

Leave a Reply