I want to share some of the Intraday Trading Rules that are relevant for me. In general, I could say that I use them to trade Stocks Trading so as Forex Trading. I show you a very small collection of Intraday Trading Rules. It is not possible to describe a full set of rules in a post. Day Traders can have Intraday Trading General Rules, Intraday Trading Strict Rules so as Intraday Trading Specific Rules.

“Intraday Trading” is a typical way to name a Daily Trading Practice to Trade Stocks. As you think, it refers to stocks traders who open and close trades during a Market Trading Session.

Among Forex traders, Day Trading is more common and it makes sense for traders who loves to trade the news.

There is a particular difference between Forex Day Trading and Stocks Day Trading. In the same way, the peculiarities of Forex and Futures show a different way to approach on Day Trading.

On Profiting.Me I share my way to trade and I explain what I do and how to do it.

Let me clarify some peculiarities of Intraday Trading Stocks so as Forex Day Trading and Futures Day Trading.

Intraday Trading Rules and Stocks Market

It is simple to explain this because for Intraday Trading the Catalyst role is important. I show you some questions:

- Why is the share price moving? What is moving it?

- What is the Price Action, so as what pattern I see in the chart?

- Is the price too high?

- Will it break the day high?

- Is the Trading Volume growing?

- Is there a “boiler room” that is pumping the share price?

- and much more…

These are common questions for Intraday Traders so as they show how Intraday Trading works. As you see, there are two important things for Intraday Traders. They are: what moves the price and with which Trading Volume. Indeed, they are relevant for the daily routine to make the Stocks Watchlist for the day.

Be aware that it is important to understand if the Stock is Liquid or Non-Liquid. Indeed, in a Non-Liquid Stock, the Catalyst catches the interest of traders. It is a necessity because the catalyst induces people to invest in that market and this affect the price. Of course, what is visible in this situation is a consistent rising of Trading Volume for intraday trading stocks.

Intraday Trading Rules are different from trading Stocks for more than one day.

When we keep a stock for a long-term the focus is not only on the usual catalysts. But it is important to consider the Price Action around the share price. Besides, it becomes enough relevant to know more about Company Details. For example the capitalization, sales, earnings and much more. Instead, for the Price Action we look for trending and unbalance visible on charts.

Forex Day Trading and Futures Day Trading

The trading of the Standardized Future Contracts happens by Futures Exchanges. An important Marketplace is the Chicago Mercantile Exchange (CME). It lets trade Currencies, Indices, Metals, Interest Rate, US Bonds, Agricultural. All these are Futures.

The most known Futures for Forex Traders are in the Equity Market and Soft Commodities Market. They are the Stocks Index Futures and Commodities Futures, of course.

The most important peculiarity is that they are High Liquid Markets. Then, it is not difficult to make trading, understanding the Price Action in the right way.

Forex and Futures could show no difference between Intraday and long-term trading. Indeed, it is just so. But we know that day traders love the Economic Calendar. This happens because of the volatility that events induce to the market. They love to ride the induced volatility just after the releasing of the Economic Report.

Intraday Trading Rules

About Intraday Trading advantages disadvantages and difficulties, these rules clarify many things.

Stocks Markets, Futures Markets, and Forex Market cannot exist without regulations. Regulators can differentiate rules for day trading and for long-term trading applying specific restrictions. In the same way, it is possible to have restrictions to get shares for short trades.

Another important thing to consider is the price behavior at the Market Opening. In the same way, It is relevant also the price behavior in the pre-market.

Of course, all these things affect the Stocks Trading Practice, but they are important. Indeed, for inexperienced traders, they could be Intraday Trading Tips for beginners.

So, Let me show a small collection of Intraday Trading Rules and Intraday Trading Tips. They are useful resources to make an Intraday Trading System to trade Stocks and Forex.

1 – Margin Account and Pattern Day Trader for USA brokers

Using a broker under USA regulation and a margin account, we have to fight with the Pattern Day Trader.

Until we open trades that run for more that 1 day, there will be no problem. But, if in 5 business days, we open and close 3 “day-trades”, we get the Pattern Day Trader Flag.

The Financial Industry Regulatory Authority (FINRA) applies this because the day trading is risky.

Intraday Trading needs a specific regulation that carries restrictions and requisites.

The main affection is that the broker will ask to set the asset to the least amount of $25000. It is not mandatory, but without it, there will be no way to make day trading. The broker will not let intraday trades.

Of course, there are always brokers offshore in Bahamas or Canada that skip this problem on the root. In this way, who cannot afford to deposit $25000, can have a trading account with only $2500 or also $500. But usually, no broker lets trade going under $500-$300 in the balance account. This happens because the Margin for trading “disappears” going under a certain limit. This happens because in the most of the cases the Margin doubles the purchasing power. Of course, there are commissions that are expensive for small accounts.

As you can see, I am not talking about the brokers that let trade Contracts for Difference (CFD). Instead, I am talking about brokers that offer to trade shares. Then, the traders need to have the money to buy shares at the current market.

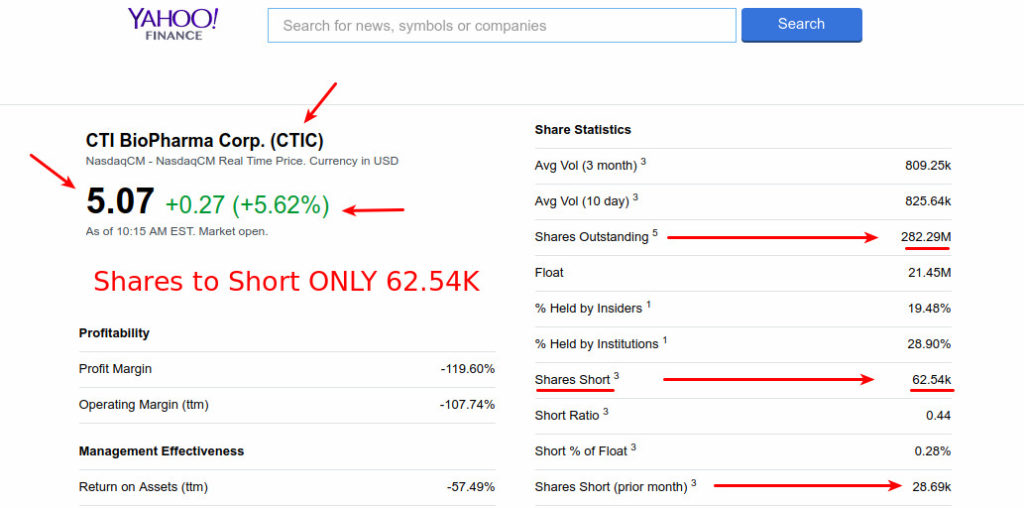

2 – Borrow Shares to Short, in advance

Making my Intraday Trading Stocks List I add also stocks to short.

One of the most important Intraday Trading Rules is:

If the broker permits it, borrow the shares to short always in advance, before they are not more available.

This is a must every time we watch a pumped stock. The price will rise for a few days, but later it will drop.

We cannot have a Sell trade on shares, but it is possible to borrow shares for short trades.

Then later, pay back the broker for the shares by a “buy to cover” order and take the profit.

The real problem is that Companies emit a limited number of shares to short. Then this limits the available number of shares to short. So when I want to short a Penny Stock for Intraday Trading, I need to check the availability on brokers. For some brokers, it is necessary to borrow shares to short in advance. The availability can change day by day and the commission to borrow stocks to short are an extra charge. So when the market open so as when the new day begins we check the available shares to short.

Another problem is that sometimes the broker can take back the shares lent. Of course, there will be no refund for the extra commissions to borrow shares to short. So, having a short trade in running we could see the trade closed in profit or loss by the broker.

This doesn’t happen every time. It is a rare situation that has specific reasons.

Of course, trading Contracts for Difference (CFD) this problem doesn’t exist, because there is no share to buy.

3 – Make the Best Intraday Stocks List and Forex Watchlist

It is important to have a concrete watchlist of what we want to invest during the day.

Between all the Intraday Trading Rules, this is like a daily routine and it can take a lot of time.

The first thing to consider always for any Financial Instrument is this:

Never lose time with what is not moving.

If a Financial Instrument is not moving there is no sense to invest on it.

Intraday Trading Rules that show How I make my Best Stocks Watchlist

- Look for the Best Gainers, low capitalized and low volume stocks which have a price change over the 5%.

- Choose for Stocks that show a Price Action favorable for good trades.

- Look for a rising in the Trading Volume. This shows if the Stock is under the eyes of traders and that traders are injecting money into it.

- Look for a Solid Catalyst that explains the rising of the Interest of Traders for that Stock. Then, a clear cause for the rising of the Trading Volume and for the Price Changing.

Intraday Trading Rules that show How I make a Daily Forex Watchlist

About the Intraday Forex Watchlist, there are some differences. The reason is that Forex is a High Liquid Market that is open without breaks for days. We are talking about Intraday Trading Rules. The focus is on a Forex watchlist for Day Trading, then for who loves the lowest timeframes plus news.

- Best Gainers and Best Losers. Look for what has a Price Change over +-0.5%.

- Look for the Events of the day with Highest Volatility in Economic Calendar.

- Choose what has a clear Price Action, favorable for good trades in the current day.

4 – Have Different Approaches to trade Forex, Liquid Stocks, Non-Liquid Stocks

Talking about Intraday Trading Rules for Stocks Trading, I show you different approaches. They follow peculiarities that depend on what moves the market. Indeed, every intraday trading system that we can develop must consider the Liquidity.

Liquid Stocks

If the Stock is Liquid, I trade just the Price Action in the simplest way possible.

Then I look for a favorable Trading Scenario that shows low-risk entries.

This is the main rule, but also in a Liquid Stock, a solid Catalyst can give a spike.

Non-Liquid Stocks

If the Stock is Non-Liquid I need to have clear the Price Action, but also what moves the price.

If I look to the Price Action, but I skip to understand what moves the price, I could get problems. Indeed, I risk a trap because in a market that is “sleeping” nobody will buy my shares.

These are Intraday Trading Basic Rules for stocks traders, that experienced traders know well. Indeed, If the market is not moving it offers only bad trades.

Forex Intraday Trading

About Forex Intraday Trading, so as for who trades just lowest time frames, I say:

The Reference Points in the Lower Timeframes Price Action could not be so strong as we would.

So, the result is that the price behavior could blow away our entries and then our trades. This explains also why Forex Day Traders love so much to ride the volatility induced to the market by Catalysts.

5 – Look for a Solid Catalyst on Stocks and Forex

The trader finds what is moving in the market and he takes a look to the Price Action. Then, he considers the increasing of the Trading Volume and he goes to look for what is causing the changing. So, analyzing the catalyst he decides to add the Stock to his watch list.

In the same way, who loves Forex on lowest timeframes, looks for the Best Gainers and the Best Losers. Then he looks at the Price Action, on what is moving the price. Besides, on what is going to move the price in the current day.

These are fundamental Intraday Trading Rules for Disciplined and Profitable Traders.

Solid Catalysts for Stocks Intraday Trading

For Stocks I look for the Best Gainers, then I keep my focus on what is raising the share price.

The price reaction on a specific catalyst is important to trade low-priced stocks.

Then Low Priced Stocks and Penny Stocks where I want to invest must react to specific Catalysts. They are Non-Liquid for the most of the case. Then it is important to understand how the price reacts on the Catalyst.

Let me show you what I trade for the most of the cases:

a – Contract Winners

A Stock is a Contract Winner when the share price rises after the public announcement of a Specific Deal.

The expected market reaction is that the price will continue to rise for several days.

The deals are specific contracts:

- Company acquisition.

- Collaboration Agreement with a Solid Company or State Agency.

- Agreement for a Company Sector.

- and much more…

b – Earnings Winners

A Stock is an Earnings Winner when the share price rises after the public release of the Earnings Report.

The expected market reaction is that the market will continue to rise for several days.

The Earnings Reports have a periodic publication with a scheduling in the Earnings Calendar.

But be aware that a positive Earnings Report doesn’t mean that the price will rise. This is why we wait for the market reaction. The market can react in a positive way so as it can react in a negative way.

c – Pump and Dump

A “boiler room” is a company or “someone who hides” that pump a Penny Stock.

Usually, the boiler rooms get money from the company that emits the shares. But they can also get money from some contributors to get advantages for their trading. Considering that this practice is not so clear, these Boiler Rooms don’t have a long life.

The boiler room collects traders contact to spread them to buy a stock.

It begins with a first email to induce the interest. Later it sends more email to pump up the share price of a Penny Stock.

Penny Stocks Traders already know about this practice. They have all the interest to join in that mailing list. In this way, they will know what that boiler room is going to pump time by time.

When the pumping will finish, the share price will collapse. Penny Stocks Traders love this because borrowing share and going short will pay them a lot.

If we are in a community we get suggestions about pumpers, but we can find them on google. Just looking for Pump and Dump and going to look for the paid links: the advertising.

Solid Catalysts for Forex Intraday Trading

For Forex Day Trading things are quite different.

The Forex market is Liquid and the Catalysts have a perfect scheduling. So, we know in advance what kind of Catalyst is going to come at a specific time.

I am not here to discuss all the Events in the Economic Calendar. The induced volatility makes spike the price for a moment and it comes from Forex Catalysts. But this doesn’t mean that the volatility changes the market behavior. Catalysts give small spikes that converge the price where there are big orders. These big orders move the market.

But for Intraday Trading Rules I prefer to look for just a few Forex Reports. I am talking about the Forex Reports that have the flag of Highest Volatility:

a – Central Bank Rate Decision

Every month the Central Banks show the decision to keep, raise or lower the Interest Rate.

b – Gross Domestic Product (GDP)

The Gross Domestic Product shows the economic performance of a country. Then it measures the growth of a country.

c – Consumer Price Index (CPI)

The Consumer Price Index shows the Inflation Data. It is a relevant element for the Central Banks to decide about the Interest Rate.

d – Unemployment Rate

The Unemployment Rate shows the number of who was looking for a new job in the previous month. It shows the health status of the country.

e – America’s Federal Open Market Committee meeting (FOMC Meeting)

The FOMC is the main ruler of USA national monetary policy. It defines the short-term targets for the FED.

Note:

The Economic Calendar Events includes every detail that explains how these Economic Indicators work. Besides, it also shows how these important Catalysts affect the relative Currencies.

6 – Opening Range Breakout

Breakouts for Day Traders are attractive and they love to trade the breaking of a resistance. But it is a risky practice and newbies lose money by it.

Opening Range Breakout is one of the Intraday Trading Rules that traders use in a frequent way.

A trader can trade Open Range Breakout in any marketplace, but it works better where there is a market opening. For example on Stocks and Futures.

When the market opens for the new Trading Session, orders let spike the price.

Day Traders that love to work on the lowest timeframes use to have charts with many indicators. So, they base their Breakout trading on Indicators, losing money.

Before the market opening the trader looks for a clear price action that shows a price range. This happens on lower timeframes. When the market opens, the breaking of the resistance in the range, offers an opportunity.

For Intraday Stocks Traders what to trade is already on the watch list and it has a solid Catalyst. So, the Catalyst supports the Price Action and the Breakout. Indeed, the trader can decide to open the trade in the pre-market, just because of the Catalyst.

For Intraday Traders that trade Indexes the Price Range defines edges to breaks. In general, on the market opening, Index Futures have a spike.

For example, European Stocks Indexes have a spike every time the market opens (in general).

The Opening Range Breakout is a risky trading practice, that I don’t recommend.

If there is no solid Catalyst, the risk becomes high for Intraday Trading Breakouts.

7 – Be a Trader, Don’t Be an Investor

This sounds like one of the most obvious among all the Intraday Trading Rules. Indeed, a Day Trader looks to open and close a trade during the same Trading Session.

The problem is that traders are not able to manage all the trades in the right way. So, many times they keep trades for days and I mean for longer in a red.

To keep Stocks investments for the long-term experienced trades need some specific skills. It is not more about the Price Action with solid reference points for a Trading Scenario. At a certain point, there will be only a trend and it is what the trader has in that moment.

The main skills for Stocks Investors now are more than the Price Action. They now are about the Company Performances time by time. I am talking about agreements, sells, earnings, growing, new products, new services, and more.

One of my Multimillionaire Mentor uses to say:

Trade the ticker, not the company – Nathan Michaud

He is right, of course.

Day Traders with a set of Intraday Trading Rules, in general are not ready for Stocks Investments.

The same thing is for Forex and Futures.

Day traders that are happy with 10-50 pips of rewards are not ready to manage trades for many months.

To work like Warren Buffett, training and experience are a necessity.

Conclusion

First, I don’t recommend to trade the lowest timeframes. But anyway, for who loves them, I suggest to build solid rules and educate the mind to the discipline.

I don’t recommend the Open Range Breakout so as the Open Range Breakdown on Forex and Futures.

Instead, trade breakout and breakdown on Low Priced Stocks, but ONLY if there is a Solid Catalyst.

I have experienced many ways to trade abandoning them one by one. I don’t waste my time trying to get 50 pips of profit on Forex Day Trading. Even, I don’t keep anymore Intraday Trading Rules.

I know well that every trade is a risk. So if I have to risk a trade it has to pay me in the best way possible.

It is different if I trade Penny Stocks because they are Non-Liquid Stocks. So they carry a high risk for long-term trading. Instead, I trade Listed Stocks and Forex in the same way because they are Liquid. I don’t risk a trade to get 10-50 pips of rewards on Stocks and Forex. On Penny Stocks, I am already happy with $0.5 per share of profit but more is better, of course.

Supply and Demand Trading give me a way to trade with high relax. My experience gives me the right mindset and the right way to understand Price Action. Besides, I am able to make a good evaluation of the Risk of Investment. Then, I know where the risk is acceptable for my Trading Style.

This is what I do day by day on Profiting.Me.

So now, let me ask you somethings:

- What are your specific Intraday Trading Rules that are fundamental for you Trading Practice?

- Are you an Intraday Trader on Penny Stocks or Forex?

- How do you trade the Open Range Breakout?

Leave a Reply