There are many Forex Trading Rules that people use in different ways. If we try to group them, we see that they can show several Trading Styles. More important is that every trader collects his own group of Forex Trading Rules to build his way to Trade.

What I want to show is a little part of those Forex Rules that I have for the Profiting.Me Students. They are Trading Tips that I collect for myself by experience and mentors.

They are also Stocks Trading Rules and much more because they are important Tips for Trading. These Trading Tips are for any Trading Practice, so as investing in Forex, Commodities, Stocks, Futures. But also for who invests in Penny Stocks, Bonds so as Real Estate.

The wisdom that comes with every Trading Tip is the result of a lot of struggle, pains and hard work.

The value that every Trading Tip gives is priceless. From the other side, the effort to get the right Trading Mindset to use them is Enormous.

These Trading Tips are Fundamental and Valuable Forex Trading Rules. They show what is necessary to get the right Forex Trading Mindset.

Some of the Most Valuable Forex Trading Rules

Let me show this little part of my most important Forex Trading Rules. They are not about Forex Trading Patterns or Trading Frameworks or Successful Traders Strategies. They are Fundamental Recommendations to become Responsible and Successful Forex Traders.

So, read them and study them with attention, even if some of them could sound obvious to you.

- Success depends on the way to Approach Trading.

- The Limit of Investment depends on the Risk Sustainability.

- Plan a Sustainable Growth.

- Don’t have the Fear to Lose.

- Avoid Scalping.

- A few Trades give the most of the Realized Profit.

- NEVER follow Trading Alerts or Trading Signals.

- Don’t wait to trade Breakout or Breakdown.

- Perfection with Entry Points is a Myth.

- Trading rewards the Quality, not the time that you put in it.

The most important value that these Forex Rules of Trading give is in the building of the Trading Mindset. They put everybody in the right direction to become Succesful Traders.

The Forex Rules are not casual rules. They are Pure Wisdom, from my years of Experience and my Multimillionaire Trading Mentors.

1 – Success depends on the way to Approach Trading

If you treat Trading like a hobby or a gambling practice, you will not succeed. Period.

Trading is a serious Business and it carries high risk. Never underestimate Trading so as Never underestimate any trade in the Trading Portfolio.

Considering that Trading is a job and not a game, it is fundamental to approach it in the right way.

The necessary work around the money is systemic, it is a process. Indeed, a frenetic practice so as the chasing carry high-risk trading and frustration to the trader. No Chasing. No Forcing.

Never Chase a Trader. Never Force a Trade.

The Trading Process is that systemic work that the trader does around what moves the price and how it moves.

The Adaptability in Trading is how we react when the market changes his behavior. Then, how to adapt our Trading Plan when the market changes and our trades are running.

The most Successful Traders Stories are never about the short-term volatility in the market. But they tell about how Successful Forex Traders were able to estimate a specific market. They tell about the Trading Scenario where the trader takes his decisions.

I make this for a living. Then I know what I am saying.

It is not about what news will move the market. Instead, it is about where the price is going and what injects in the market money. The money injection by the market makers pushes the price in a direction. Besides, consider where the money injections occur and what keeps up the momentum.

2 – The Limit of Investment depends on the Risk Sustainability

You need to understand the Sizing for your Trades.

If you invest all the money to double the account in the short-term, soon or later the balance will collapse.

But in my career, especially working for a broker, I have seen many traders go to risk everything. They were able to spike up the growing of the balance account getting a high percentage of growing. The relative percentage of growth in a time interval was insane. I am talking about “thousands percent” of growth. Then, at a certain point, they collapsed one by one. Every trader with these peculiarities loses everything with just 1 or 2 trades.

Every Gambler will not have a life long and prosperous in Trading.

I want to make clear that the Risk Sustainability is not the Stop Loss. Definitely.

There is a correlation between the Risk Sustainability and the Growth Sustainability. It is about how much money you can afford to lose without compromise the Growth of the Account.

In a perspective in which the trader keeps up the Account Growth, there is a Margin Loss to don’t exceed.

Of course, this assumes that there is a proper Growth Plan that demands discipline. This suggests an important thing:

we could define the Margin Loss or Margin Risk by the Targets in the Growth Plan.

3 – Plan a Sustainable Growth

A Plan to sustain the Account Growing and a Plan to define the Position Size.

These 2 things sustain the Account Growth and manage the Growth Sustainability.

Successful Traders Strategies make money. But how to manage the account in the right way?

Growth Plan and Size Plan are in a correlation and the merging makes a complete Growth Plan.

A Growth Plan is a series of Intermediary Targets to reach up one by one until the Final Goal.

Everybody can make his Growth Plan in the way he prefers. I am not here to tell how to do it.

But If we consider the Growth Sustainability, a planned Growth can also depend on the Size per Trade.

A Sizing Plan is a series of steps that shows the amount of money to invest per trade.

The most important thing is that every step follows a specific Mathematic Function. I know that this sound strange. Of course, you can simplify everything in the way you like.

But usually, experienced traders use a Function Series, Function Quadratic or a Function Conic. It marks the steps of the plan and then the Scalability of the amount of money to invest per trade.

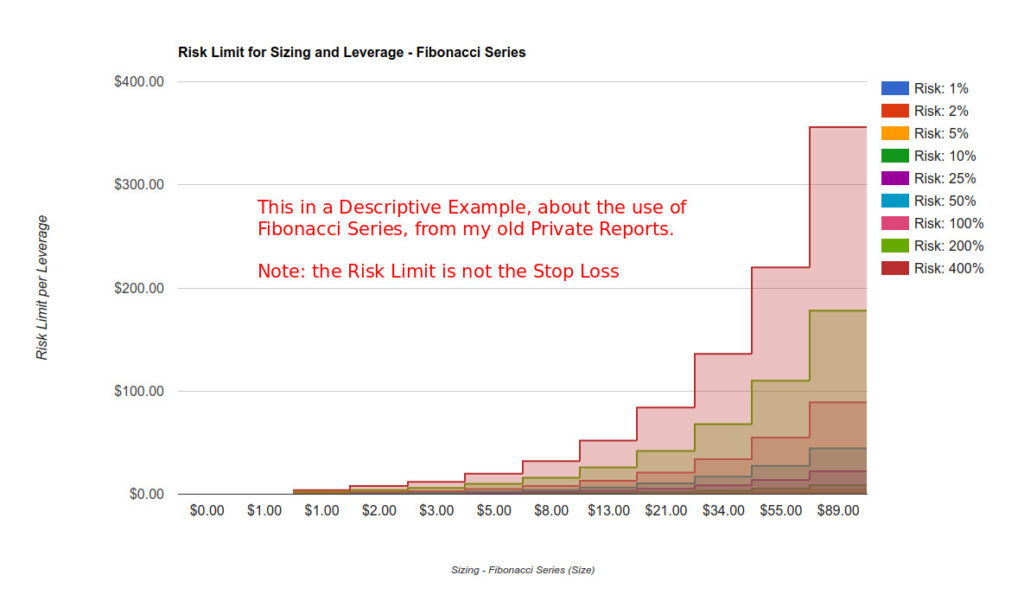

I use of the Fibonacci Series to define the Scalability and the Growth Sustainability.

The correlation between Growth Plan and Sizing Plan is now clearer. Reaching a new Target of the Growth Plan, we move to the next step of the Sizing Plan. In this way, we increase the amount to invest per trade.

Traders with Solid Forex Trading Rules make a proper Growth Plan and a proper Sizing Plan.

4 – Don’t have the Fear to Lose

Avoid the Fear of Missing Out (FOMO). Avoid the anxiety.

I debunk a myth:

It is not true that the Fear of Losing money doesn’t affect an experienced Trader.

Newbie or experienced trader can feel so much fear to live bad days by wrong trades.

The fear of losing money is a constant in the life of a Trader. This happens because losses happen.

In a Trading Scenario, several entry points have descendant risk degrees. A Trading Price Range can show several entry points favorable for new trades to take. Every entry useful for a trade must have an acceptable risk, according to our trading style. Thus, going deeper in the Trading Price Range, the risk per entry point becomes lower.

So, we can look to set orders also where the entry points carry a higher risk. These trades could run in red at least for a moment. Then, if this will persist for enough time also the experienced trader gets frustration.

Invest $100 is different from invest $1.000.000. The mind needs more training to manage the feelings for the risk around big investments.

How to Educate the mind? We do it working on the discipline to follow and respect a Growth Plan and a Sizing Plan.

Every step of the Sizing Plan increases the amount of money to invest per trade in a progressive way. So we educate our mind to manage the risk for the new size.

There is no certain around entry points that we can take. We work with probabilities following what we already know.

Forex Trading Rules help us to make better time by time, educating our mind.

5 – Avoid Scalping

Many people aim to realize small gains here and there, adding them up. But soon or later there will be that wrong trade that will burn everything. That trade blows away all the small gains added up in a week, a month or a year.

This is scalping and the result is an insane trading. It carries an extreme risk to get in reward only a few pips.

There is no sense to Risk a Trade to get in reward only a few pips of profit. Period.

Trading carries a high risk. Newbies must understand that every Trade is a Risk. Trading is not a Game so as It is not the “Casino de Monte-Carlo”.

Trading is a JOB. It is Pure Business. Treat and approaches to it for what it is.

I always make a proper evaluation of the risk before to choice where to set my orders. Despite the prudence, the accuracy, and the experience that I can have, I make mistakes too.

I open only a few trades and I look only for opportunities that can pay me a consistent reward. I measure the potential rewards in Price Change Percentage. So, I favor always trading opportunities that can give a reward that is 5% or more in Price Change.

I don’t risk a trade to get in reward only a few pips of profit. NEVER!

If I close trades with a low reward, it means that my Trading Plan has gone to fail.

A Trader NEVER should forget that he makes trading to earn money and no to play.

Every wise investor stays away from high-risk investments that give nothing in reward.

Rule No.1: Never lose money. Rule No.2: Never forget rule No.1. ~ Warren Buffett

6 – A few Trades give the most of the Realized Profit

The biggest part of our Realized Profit comes from just a little number of trades.

Indeed, even if we trade day by day with assiduity, we could not get satisfaction with the Profits.

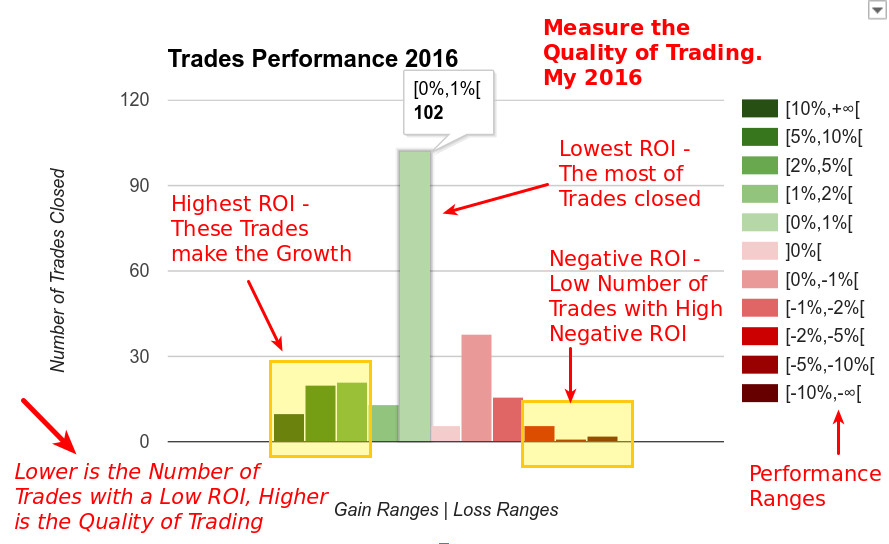

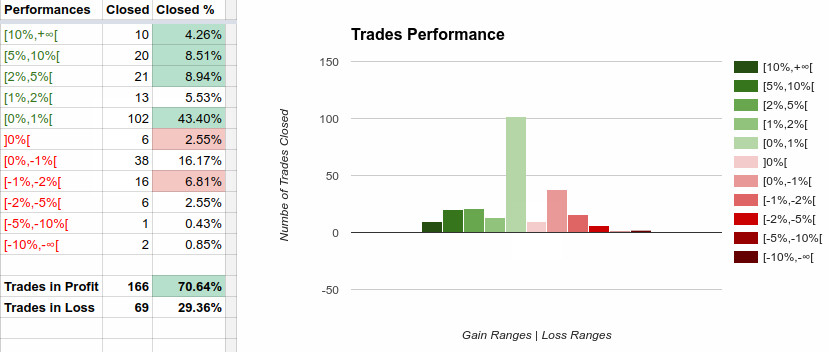

If we measure Performances by ROI (Return on Investment) we get useful details.

Grouping the trades per Range of Performances, it is possible to have a view of the Quality of our Trading.

Every Performance Range collects trades with ROI between an Interval. Let me show an example.

For many Traders, all the trades closed in profit could be in Performance Ranges like these:

- 0 and 1%.

- 1 and 2%.

- 2% and 5%.

- 5% and 10%.

- 10% and 20%.

This grouping shows that the most of the trades closed have ROI not higher than 1%.

In the same way, it shows that only a few of the trades closed are over the 5% of Profit.

Only a few number of trades give us the biggest part of the Realized Profit. These important trades are the ones with the highest ROI: over 5%, over 10% so as over 20%.

Of course, this is an example. Everybody has his trading style with low leverages so as high leverages. This means that the Performance Ranges are different case by case.

The grouping of the Trading Performances shows if the Quality Trading is high or low.

The Highest Quality Trading doesn’t depend only on trades closed with the highest ROI. Instead, The Highest Quality Trading comes reducing the number of trades with low ROI.

This can happen only improving our Trading Practice day by day, year by year.

7 – NEVER follow Trading Alerts or Trading Signals

Use all the information you get to make your own Trading Plan. Learn from the others but DON’T follow their trades.

From all the Forex Trading Rules I have, this is the only one that newbies love to break with continuity. Indeed, the most of them lose money so as stay so lazy as they are. Instead, those which realize that they are making a mistake try to change their habit. Some of them get chances to succeed in Trading.

Lazy Traders are the best lovers of Trading Signals. I told this many times. They never will be successful Traders. They are slaves of their desires. Just like the Gambles. They play and they lose. They don’t find a way to stop, then they continue to lose repeating the same mistakes time by time.

People lose money by Trading Signals because they refuse the work to trade in the right way.

They prefer to Buy or Sell where everybody tells to do it, instead than understand the Price behavior. Even they reject the work to understand the price action around the Signals that they get.

So, they don’t want to understand one of the most important Truths about Trading:

Nobody can pretend to give or sell the Perfection in Trading. Even those who steal the money of newbies selling Forex Trading Signal flaunting luxury.

From my Forex Trading Rules, this one is the most unheard. Indeed, the most of the trades don’t succeed. Even, I don’t recommend Copy Trading.

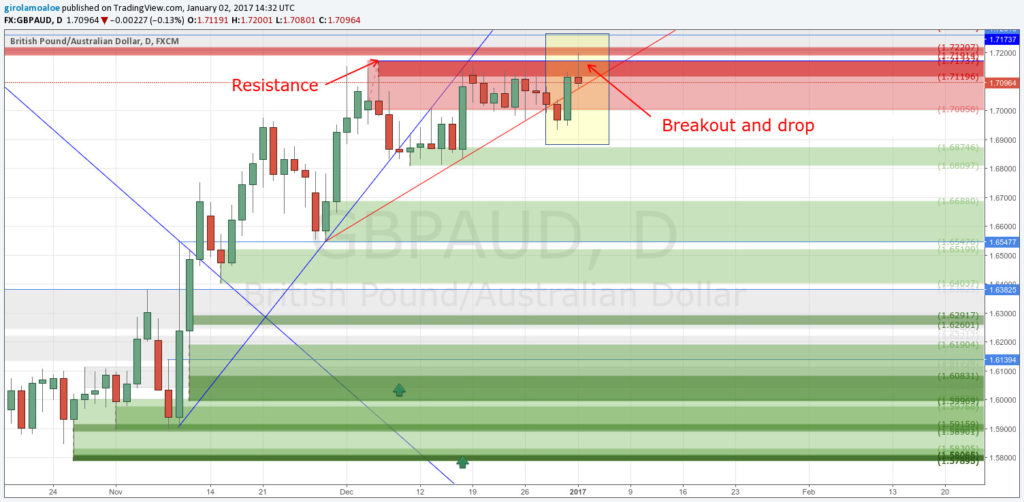

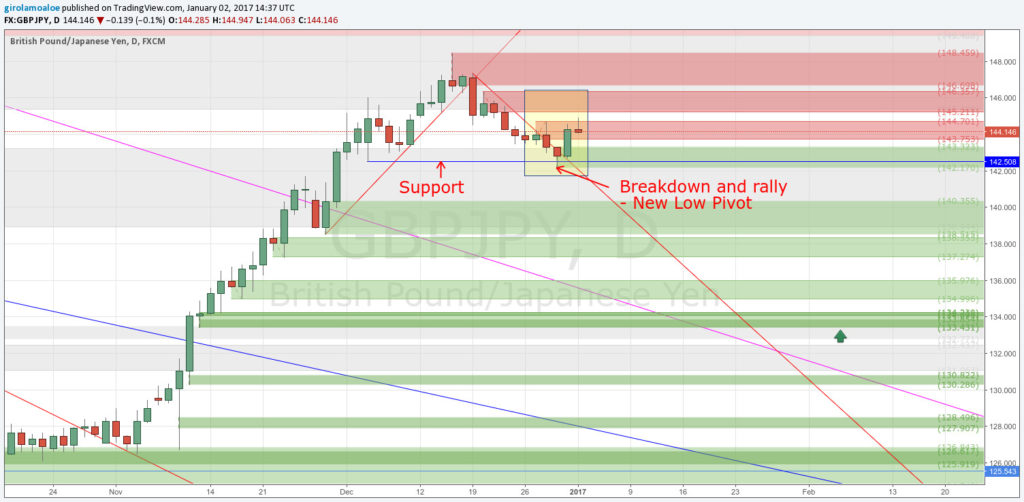

8 – Don’t wait to trade Breakout or Breakdown

Sell in the Convergence with a Strong Supply Level and Buy in the Convergence with a Strong Demand Level.

Look for entry points with a low risk, don’t run for trades that carries the highest risk possible.

Breakouts and breakdowns in a Liquid Market carry high risk.

The price can mark a high pivot or a low pivot and turn back. Then, on a breakout or breakdown, a trade can turn in red eating money more and more.

Instead, False Breaks can give good rewards. But this is more a trading practice typical of expert day traders.

In any case, there will be always a convergence. Then, the price will always converge to a Supply or Demand Level.

Where the Trading Scenario shows a possible solid opposition, it offers a trading opportunity. Even if the price action will mark a new pivot breaking a resistance or a support. The high pivot or the low pivot will always be counter the breakout and counter the breakdown.

In a Liquid Market, Don’t Buy high on the breakout, Don’t Sell low on the breakdown. Period.

This is one of my most important Forex Trading Rules.

Newbies lose a big amount of money buying high and selling low on Forex. This happens because they read wrong information about how to trade.

9 – Perfection with Entry Points is a Myth

Nobody is smarter than the market and Nobody can pretend the Perfection.

A trader becomes specialist dedicating years of his life learning and practicing. But we work with probabilities and we know that we never can take a perfect entry point every time.

Even working hard for a whole life we will not skip losses in some trades. So, accepting this we can go to become Profitable in a Consistent and a Constant way.

Sometimes, with experience and training, we are able to get the right entry points. This is possible because Supply and Demand Trading gives a strong help in this.

The refining of Supply or Demand Levels gives a consistent reduction of the risk.

But it is necessary to understand where the price action shows concrete opportunities.

Indeed, there is no real Timeframe to trade. But there is only a Trading Scenario with all its peculiarities.

We cannot be perfect but I took many perfect trades on solid Supply and Demand Levels.

In this way, we can cut the risk and get solid entries looking for where are the money.

Everybody who sells Trading Signals or Trading Alerts never will be perfect. Nobody will be perfect all the times with their entry points.

Forex Trading Rules exist to make a better trading staying away for dangerous situations. This is possible keeping the focus on favorable opportunities even knowing that we cannot be perfect.

10 – Trading rewards the Quality, not the time that you put in it

Trading rewards the market knowledge, the experience, and the strategy. It is not a 9-18 daily job.

In the same way, it is not a business that rewards the time you put in it.

What trading gives is the way to earn money in a Liquid Market and in a Non-Liquid Market.

Forex Trading Rules give me a safeguard. They are Forex Trading Guidelines to stay far away from problems in a Liquid or Non-Liquid Market.

In the same way, the Forex Trading Rules show how to trade with a low effort and with high quality.

Quality Trading comes from discipline and the quality gives good trades by low effort.

This means that the trader’s work is low. Instead, when the trade is running the money work for the trader.

I always repeat the common sentence:

Let the money work for you.

I repeat it in any moment because it is what I do in my portfolio. For example, I usually have several trades in running and I go to exercise cycling around.

It is not necessary to spend our daily routine trying to take trades. Instead, it is to understand where to take a trade, set the order and let the price execute it.

Later, let run the trade without forget to adapt the trading plan to the changes in the price behavior.

The Quality pays large profits in any marketplace, by successful trades.

Instead, a trader should dedicate the most of his time in his training, as a first thing. Later, he builds his own personal life so as any other thing.

Conclusion

I studied a lot to become the trader that I am today. Every day is a new day of learning and improving. There is nothing to consider with superficiality in this business. Even the most obvious Tips and Tricks demand a lot of commitment and dedication.

Trading is a job of Dedication and Persistence. Nobody can work without solid Forex Trading Rules.

Let me make clear how the things work:

I can go to the market to sell homemade Chocolate bars.

If I have a strong demand I raise the price of my product. In the same way, if the demand persists, but my product is a short supply, I can raise the price.

Instead, if there is low demand It is better to cut the price of my product. So as, if the demand stays low and my product is abundant, It is good to cut the price.

This is how any Marketplace works.

Forex Trading Rules help to trade at the right moment, in the right way, and at the right price.

These 10 rules a little part of all my rules for Forex Trading and for Stocks Trading. They are useful and show what is a right Mindset of Succesful Forex Traders.

The Profiting.Me Students work hard to move their efforts in the right direction changing their Trading Approach.

Make Trading with responsibility and wisdom is the first thing. it leads us away. All this comes building solid Forex day trading rules so as persisting for the long-term.

So, let me ask you something:

- Which of these Forex Trading Rules so as Stock Trading Rules are familiar for you?

- How you do you measure the Quality of you Trading?

- How do you manage the Trades in Loss?

- Do you have a Growth Plan?

Leave a Reply