The Float Rotation is the Price Rotation from a specific level. It can happen repetitively following a trend. It defines highs and lows and generally the rotation is also attracted by a magnet price. In practice, it means trade every potential snap up and wash out that seems reasonably profitable in a floating chart.

Trading the Float Rotation is a good way to make money in any market. It is a known practice in stocks markets, considering also the help that the volume variations give to trade liquid stocks can give in trading. If you look only to the Price Action, you can trade the Float Rotation in every chart.

Trade the Float Rotation is a trading practice for expert traders and every trader should wait the right reversal signal and catch the right entry point.

Make trading on a Float Rotation is risky and not every trade triggered will be perfect and some of them can give you a loss.

An expert trader knows when to scale and when to cut the loss, particularly on Float Rotation.

Understand the Price Action in Float Rotation

Trading the Float Rotation does not mean buy low and sell high. In the most of the trading situations the Price Action is the key to make a good trading in a Floating Chart.

The right moment to trigger a trade is different for every trader. For people who follow the Rule #1 – Cut Losses Quickly, is better wait a reversal signal that usually shows the breaking of some close level and take attention to Highs and Lows of Waves.

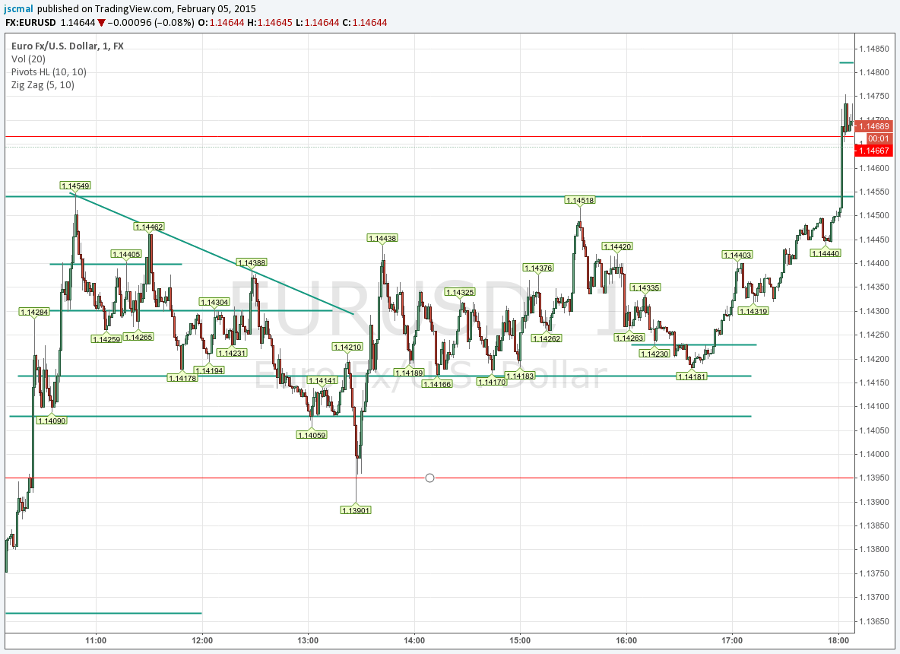

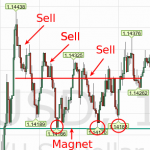

EURUSD Float Rotation examples – Feb 15, 2015

Click any image to enlarge the gallery

The key is just catch the breaking after every reversal signal, following a clear behavior of the price moving and considering to trigger only potential trades where the rewards is relevant.

In the Float Rotation the Risk is High, but also the Reward is High knowing what to do.

- In this specific trading practice the Anticipation is crucial to get a higher profit. But Anticipate a breaking is a very risky practice.

- My Mentor teaches that Anticipate in the best way is just follow a clear movement toward the breaking level, no choppy. This is just showed in the images 3 and 4.

- The image 2 shows several snaps up and washes out of the price moving, attracted by the magnet price level. In this specific chart, buy on the magnet is very risky, but sell after each snap up, after the reversal signals, is more comfortable.

- The image 1 shows a clear and small Parabolic Gap Up Pattern, very easy to trade in sell, but always risky.

In general a Float Rotation seems like a Choppy Chart with Good Opportunities.

If you want to learn how to make trading, but particularly how to trade the Floating Rotation, I suggest and recommend to invest some money in your education, because It was good for me to improve. I studied the Tandem Trader DVD by Investor Underground.

Have a Mentor is the best thing that happened to me for my trading experience. Find what is good for you to study, learn from it, make practice and improve your trading.

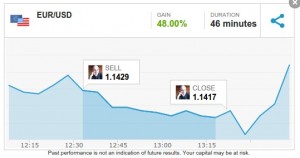

The Best Trades of mine on EURUSD – Feb 5, 2015

Many good opportunities for expert traders that trade the momentum. I made many mistakes, but I did my best. Learn from every mistake.

If you don’t have a plan, you don’t have a trade. ~ Nathan Michaud

A wrong thing is just don’t have a plan or broke the plan that you set in advance for a trade.

Find these EURUSD trades in the images that you have seen above.

This blog post is also a way to analyze the mistakes that i did trading the Float Rotation in the day Feb 5, 2015. The overall realized is in profit, but my manual trading is not going as I would like.

The Losses were higher of the Earnings, but it was a Great Trading Practice on Float Rotation for my learning process.

Leave a Reply